Comments on Alibaba’s Third Quarter Earnings

Steady Progress Amid Challenges: Evaluating Alibaba’s Path Forward

This article continues the ongoing discussion I’ve had about Alibaba. My focus is straightforward: instead of analyzing every single detail, I highlight what stood out to me this time, cutting through the noise and focusing on key observations.

For context, I’ve written extensively about Alibaba in the past. For example, I’ve covered the strategy shift from Daniel Zhang’s tenure to the leadership under Eddie Wu and Joe Tsai. In my piece on last quarter’s results, I highlighted the early progress they made. I won’t repeat those points here in full details—you can revisit those articles in case you are interested. Instead, let’s examine what’s new and noteworthy this quarter.

How I currently think about Alibaba

Before I start, let me quickly recap how I currently view Alibaba. Alibaba is primarily about e-commerce: Chinese e-commerce represented by Taobao and Tmall, and international e-commerce under the Alibaba International Digital Commerce Group. This is supported by logistics provided by Cainiao1, as well as instant logistics and delivery represented by Ele.me2. Another core unit is their cloud and AI business. Everything else is essentially non-core, and I might not discuss it in detail/at all, although there are some interesting developments.

General comments:

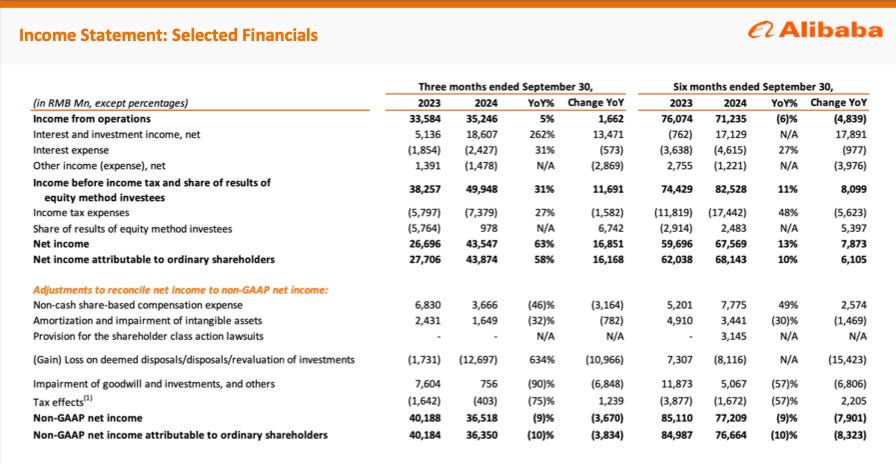

To start with, here are the basic numbers for your reference.

Comments on Macro:

Of course, they were asked about the recent government stimulus policies and their impact on the macro environment.

We’re optimistic about the government’s macro stimulus policies and confident in their positive long-term economic impact. These programs are definitely stimulating growth in sales within the relevant categories. We believe these stimulus measures are just getting started and will, over time, have a positive effect on driving overall consumption.

In particular, these policies should help reduce merchants’ destocking cycles and have a medium- to long-term impact on boosting the consumption of branded goods.

However, they also acknowledged that e-commerce competition remains intense.

Comments on Capex:

Alibaba’s capital expenditures are focused on cloud infrastructure, especially AI, driven by their understanding of both short-term and long-term demand. In the short term, they are seeing explosive growth in demand for AI, including the compute power that drives AI and the API services used to access models. The demand is so high that it is currently impossible to fully meet it, prompting aggressive investments.

In the long term, Alibaba views generative AI as a historic opportunity—one that occurs only once every 20 years. This opportunity enables technological leapfrogging, with AI being applied across industries for automating workflows and retraining models. A key trend underpinning this shift is the transition from CPU-based computing to GPU-based architectures, which are driving massive AI adoption.

Alibaba also noted that AI developments in China are progressing similarly to those in the United States. Both countries are seeing rapid innovation, with companies in various industries developing their own AI agents. This parallel highlights the transformative potential of AI on a global scale, positioning Alibaba to capitalize on these advancements.

This is very interesting to see because, in contrast, Tencent mentioned in their earnings call that AI development and adaption are much slower in China compared to the United States.

Management said:

Given the circumstances, you can expect to see EBITA fluctuate over the next few quarters, as we are currently in an investment phase.

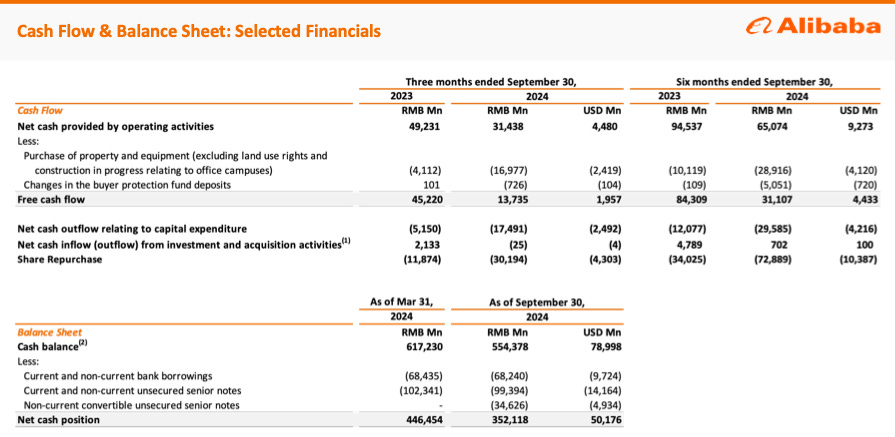

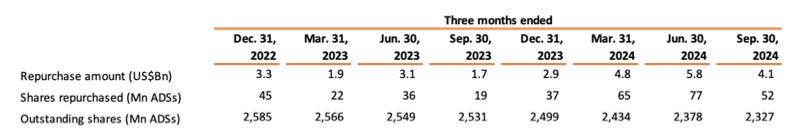

Share-buyback

Share buybacks continued, and they still have $22 billion USD remaining in their share repurchase program. They stated that future buybacks will also depend on the share price to maximize shareholder value.

Overview of Alibaba’s Business Units

Let me briefly discuss the different business units one by one.

Taobao and Tmall Group

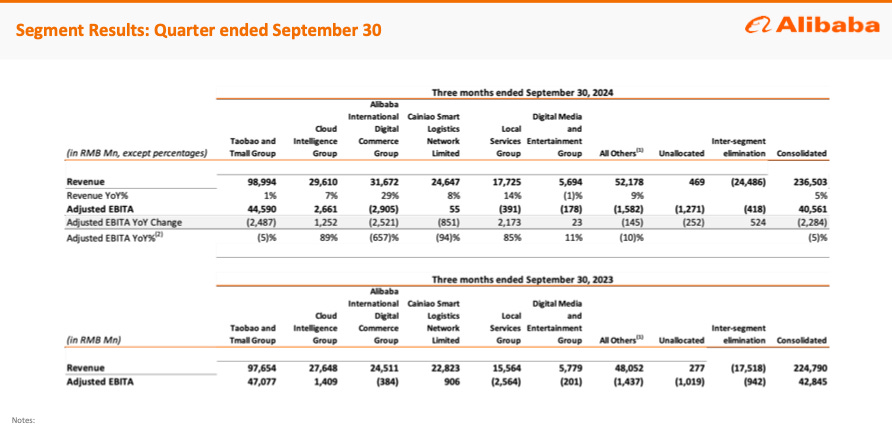

The overall picture for Taobao and Tmall in the third quarter reflects trends echoed by other companies. Alibaba reported increased traffic and double-digit order growth, but with smaller average order sizes—consistent with what Tencent mentioned recently.

For the Double Eleven Festival, Taobao and Tmall saw a strong boost in live streaming performance, particularly compared to other live streaming platforms that struggled. Trade-in subsidies for appliances and other products significantly contributed to this success. Additionally, the new collaboration with Tencent, which allows WeChat Pay integration with Tmall, has brought in more customers and traffic from Tencent’s network.

That said, turning things around still requires time. The new management team has been in place for a while, and there are promising signs, such as the introduction of a 0.6% software fee and further adoption of Quanzhantui their AI-powered marketing tool. However, the unit is still navigating new business models with low monetization, which will take time to mature.

Some people have pointed out that JD’s quarter was much better than Alibaba’s, and I fully agree. However, I believe this is largely a reflection of what I’ve already discussed in my previous articles.

As I mentioned in my very first Substack article, when this team took over from Daniel Zhang, Alibaba was significantly behind the curve.

There is a striking contrast between JD.com and Alibaba, especially in their strategic approaches to business adjustments and market challenges. Both made the huge mistake of allowing Pinduoduo to become a significant force in Chinese e-commerce, despite their dominant positions a few years ago. However, JD.com recognized this much earlier. When founder Richard Qiangdong Liu returned last year, JD.com made the necessary adjustments…. In stark contrast, Alibaba is currently in the early stages of making similar strategic adjustments.

While some progress is visible, it’s a long road to recovery.

This is from my comments on Alibaba’s June quarter. I believe it still holds true:

While all of this sounds promising, it will take time. Even if they are now making the right decisions, it will take several quarters before these changes are visible on the balance sheet.

Cloud Intelligence Group

The mere 7% revenue growth was disappointing, especially since management had guided for double-digit growth in the second half of this year. However, this was not entirely surprising, given the various factors at play behind the scenes.

As previously discussed—and reiterated this time—Alibaba is phasing out highly customized, low-margin cloud business contracts. This has been weighing on revenue growth, offsetting positive developments in public cloud and AI-related cloud services. Public cloud grew by more than 10%, and AI-related cloud achieved triple-digit growth year over year.

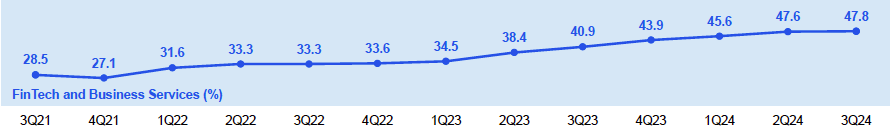

Essentially, Alibaba is following Tencent’s playbook, which announced a similar strategy several years earlier. However, looking beyond revenue growth, we can already observe some very promising developments.

In the June quarter, the Cloud Intelligence Group increased revenue by approximately 1.5 billion RMB, which boosted adjusted EBITDA by 1.4 billion RMB. In the September quarter, revenue grew by roughly 2 billion RMB, while adjusted EBITDA rose by 1.2 billion RMB. This demonstrates that, at present, nearly every increase in revenue is directly contributing to earnings and flowing to the bottom line. The current adjusted EBITDA margin of the cloud unit is 9%.

To give you a better understanding of how this Tencent playbook can work out, here’s Tencent’s gross margin development for their FinTech and Business Service unit. I know it’s not directly comparable to Alibaba’s cloud unit, but you can see that Tencent implemented a similar strategy of phasing out low-margin contracts and increased the gross margin in this segment by more than 20% over the past three years.

In the recent quarter, Alibaba Cloud has demonstrated significant progress both internationally and domestically. Internationally, it has entered a strategic partnership with Indonesia’s GoTo Group, committing to provide cloud services for five years. Domestically, Alibaba Cloud completed a substantial data migration for Xiaohongshu, transferring 500 petabytes of data.

Alibaba Inernational Digital Commerce Group

Like all Chinese e-commerce players, Alibaba is expanding abroad. They’ve chosen to target the European and Gulf markets through AliExpress, AliExpress Choice, and Trendyol. These units are currently heavily loss-making, but they’re also among the few where Alibaba is seeing fast growth, with growth rates around 30%. The strategy is to invest heavily in key growth markets identified as strategically important for expansion, while simultaneously enhancing operational efficiency in less profitable markets.

Interestingly, Lazada is rarely mentioned anymore, suggesting that the Southeast Asian market is less of a focus for Alibaba. This is supported by filings from Sea Limited, which is now profitable and cites a rational competitive environment—likely because Lazada has shifted its focus to improving profitability and monetization.

Cainiao and and Local Services group (Elema)

I see these units as primarily supporting Alibaba’s core business, so I don’t focus much on the financial figures they generate. However, two developments stood out to me.

First, Cainiao has started providing logistics services to other e-commerce players. This opens up new revenue streams, which could eventually contribute meaningfully to Alibaba’s overall profitability, as these earnings wouldn’t simply be a transfer within the company.

Second, Ele.me’s performance has been particularly noteworthy. For years, it was deeply loss-making, with growth numbers lagging behind Meituan, which operates a similar business model but has been highly profitable. This was the case under Daniel Zhang’s leadership. Since the new management took over, however, they’ve made significant progress, dramatically cutting losses while maintaining nearly the same growth rate. Ele.me is now on the verge of breaking even, which is a substantial improvement given its history of burning through large amounts of cash. Beyond profitability, I believe Ele.me’s value is primarily strategic, and I never gave much credence to the rumors about Alibaba selling this unit to ByteDance.

Digital Media and Entertainment Group

It’s certainly non-core and too small (Revenue just about 5.7 billion RMB). I have nothing to add here.

All others

This unit, though massive with 52 billion RMB in revenue—nearly 10 times that of the Digital Media and Entertainment Group and comparable to the Cloud and International E-commerce Group combined—is rarely discussed. It’s essentially a collection of Daniel Zhang’s failed projects, primarily from his new retail initiative.

Despite being non-core and consistently loss-making, this unit has shown promise, achieving 9% year-over-year growth driven by FresHippo (I wrote about it here) and Alibaba Health after scaling back Sun Art.

Some of the businesses are achieving profitability even sooner while the majority will achieve breakeven within 1 to 2 years and gradually begin to contribute profitability at scale.

Joe Tsai has expressed intentions to divest these assets, though poor market sentiment has delayed sales.

With assets like FreshHippo, Sun Art, Fliggy, and Alibaba Health, the group could potentially fetch $20 billion in better market conditions. However, when considering divestments, Alibaba should not only focus on what they can get for a unit but also consider their own share price. For instance, selling FreshHippo for $6 billion and buying back shares at $70 per share would yield the same result as selling it for $12 billion and buying back shares at $140. The decision should be a function of both the asset’s valuation and the company’s share price.

Summary:

Looking ahead, I believe it’s crucial to see more tangible results from the management’s actions in Chinese e-commerce and whether they can effectively follow Tencent’s cloud playbook to further increase margins. At the same time, progress in other business units is necessary—either by achieving profitability or, ideally, by divesting some non-core assets.

Until then, what Tencent noted in their earnings call seems to apply here as well: Alibaba is performing reasonably well despite a challenging macro environment. Everybody knew Q3 was bad, but with government stimulus now starting to take effect, there’s hope that things will improve going forward.

Cainiao, in my view, primarily supports the broader e-commerce ecosystem rather than functioning as standalone units. From an analytical perspective, I don’t place much importance on how much profit Cainiao generates. The reasoning is straightforward: where the earnings are booked doesn’t fundamentally matter. If Cainiao is profitable, it’s because platforms like Taobao are paying it more, which simply increases their costs. Conversely, if Cainiao incurs losses, the other units record higher profits. Either way, the overall financial picture remains unchanged.

Ele.me, in my view, has strategic value that goes far beyond its financial results or business economics. It supports Alibaba’s instant delivery market, a highly valuable asset. This importance was made clear by the challenges faced by ByteDance and other players who tried to enter the local services market without established instant delivery capabilities.