Comments on Tencent’s Third Quarter Earnings

Stable performance despite a challenging macro environment and an exciting new development

In this article, I provide a personal summary of Tencent’s Q3 2024 earnings, highlighting key points that stood out to me rather than covering every detail.

What consistently impresses me is Tencent’s management quality and strategic focus. Their approach is clear and highly disciplined, and whatever they predicted a few quarters ago ultimately materializes. This can be seen in these points:

1. Decisive Changes in Game Monetization

Several quarters ago, Tencent expressed dissatisfaction with the monetization teams for certain games. They took decisive action, replacing these teams entirely, and forecasted improved results in the following quarters. This quarter’s performance has validated that prediction.

2. Shift Towards High-Margin Businesses

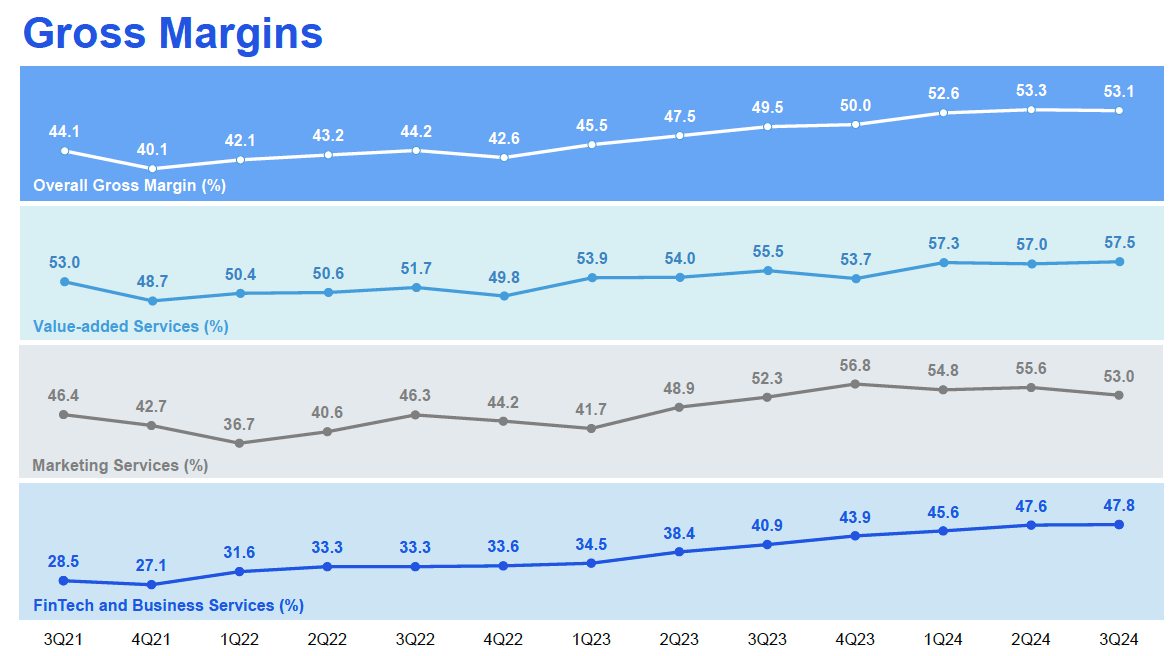

Over a year ago, Tencent adapted its strategy to the weaker Chinese economy by phasing out lower-margin operations and focusing on high-margin businesses. Although revenue growth has been relatively modest, operational earnings have seen significant leverage growing 2.x times the revenue growth rate. This is clearly reflected in the cloud business, where gross profit margins increased from 27.1% in Q4 2021 to 47.8% this quarter—an impressive 20% gain that was anticipated in their forward guidance.

Alibaba eventually followed suit, phasing out low-margin segments in their cloud business. That’s why they are projecting 10% growth in the cloud business for the second half of 2024 following Tencent’s example.

3. Consistency and Strategic Execution

Across each quarter, Tencent has demonstrated a remarkable commitment to its strategic goals, delivering on promises and adapting to changing market conditions. This quarter also introduced a new development that I’ll discuss in detail later - you like that cliffhanger don’t you? (You can find it in the section New Development: Mini-shops below)

Here are their Q3 results in case you have not seen them yet.

Domestic and International Games

As anticipated a few quarters ago, both domestic and international games resumed and accelerated growth. Domestic games revenue grew 14% year-over-year, driven by DnF Mobile’s first full-quarter contribution (ranking as the second-highest grossing mobile game this quarter) and the strong performance of Tencent’s evergreen titles. However, management has cautioned that DnF’s contribution will stabilize in the fourth quarter.

While the fourth quarter will be a consolidation period for DnF mobile, we will release some major content update for Chinese New Year intended to further enhance user engagement and monetization.

International games revenue increased by 9% year-over-year, largely due to revenue-lagging gross receipts resulting from extended deferral periods.

Value-added Services / Social Networks

At first glance there’s nothing particularly noteworthy; it’s a continuation of previous trends. Music subscriptions and long-form video revenue grew by 20% and 4%, respectively. However, these gains were offset by decreased revenue from low-margin music ($TME) and game-related ($HUYA) live streaming.

Now comes the interesting part:

In my comments on the second quarter, at the very end I discussed the revenue-sharing conflict between Tencent and Apple concerning App Store fees.

DnF mobile was solely distributed directly by Tencent through its own channels, bypassing traditional app stores and the corresponding fees. The huge success must have reassured them.

This strategy is evident in Huya’s recent financial reports, which show a more than 20-fold year-over-year increase in game distribution activities. Tencent is building up Huya as a key game distribution platform, allowing them to bypass app stores.

Marketing Services (previously Online Marketing)

Revenue grew 17% year-over-year, driven by strong performance in games and e-commerce categories, while real estate, food, and beverage segments remained weak. Brand advertising, compared to performance advertising, is still underperforming but received a temporary boost from the Paris Olympics. However, management has cautioned that this positive factor will not be present in the fourth quarter. Within the WeChat ecosystem, video account marketing services grew by 60%, mini-programs showed robust growth, and as outlined a few quarters ago, WeChat search has become more monetized, with revenue doubling year-over-year.

Despite weak consumer spending, Tencent has managed to increase its market share in advertising. It’s evident that advertisers are competing intensely to capture the attention of these more cautious consumers in China.

Fintech

If you want insight into how Chinese consumers are faring, just look at Tencent’s filings: people are saving more and spending less (transaction volume is up 10%, but ticket size is smaller).

FinTech Services revenues in aggregate remained largely stable compared to the same quarter last year, within which wealth management services revenues increased year-on-year due to more users and higher aggregated customer assets while payment services revenues declined due to subdued consumption spending.

Tencent Q3 2024

Interestingly, they also discussed the mutual benefits for Tencent and Alibaba now that WeChat Pay is available on Taobao. I wrote about that previously here:

Business Services

Business services saw year-over-year revenue growth, though no specific figures were provided. This growth was mainly driven by cloud services and fees collected from e-commerce transactions. Revenue from GPU-powered services grew rapidly, a trend also noted in Alibaba’s recent filings. Interestingly, Tencent Cloud also significantly increased its international revenue.

Tencent thinks AI revenue in China’s cloud sector lags behind that of U.S. cloud companies due to several factors: China’s enterprise market is smaller, lacking the widespread AI integration seen in U.S. companies; there is a less vibrant SaaS ecosystem in China, where AI is often added to products to boost functionality and pricing in the U.S.; and fewer AI startups in China are purchasing large amounts of compute power. As a result, while AI revenue in China’s cloud sector is stable, it is unlikely to scale rapidly like in the U.S. Currently, AI’s most immediate, scalable impact in China is in content recommendation and advertising.

New Development: Mini-shops

This quarter’s standout development was Tencent’s shift in focus from video accounts to a new feature: mini-shops.

We upgrade our e-commerce strategy around mini shops to create a unified and trustworthy transaction experience spanning the entire Weixin ecosystem.

This aligns with Tencent’s earlier guidance to use video accounts as an entry point into e-commerce. Management is clearly excited about the potential, and so am I, as this seems to be a significant step. Tencent is now fully leveraging WeChat’s social interactions, content, and payment capabilities to establish storefronts for an e-commerce marketplace.

For the first time, Tencent is positioning itself directly as an e-commerce player, referencing onboarding merchants, customers, and deposit requirements, order tracking, and return periods—terms standard for an e-commerce business. This marks a strategic shift as they pursue the market aggressively. With their robust ecosystem of social interactions, Moments, mini-programs, payment capabilities, and short videos, Tencent is poised to become a formidable player.

If this does not scare you as a competitor then I don’t know what will:

With this upgrade, what we'd believe is that the shopping experience for consumers would improve as there is a better quality assurance on the products and they also enjoy better shopping experience, such as order tracking, express return because now we know what kind of products have they bought and from with merchants that they have bought from. And for the merchants, they would actually enjoy better transaction support as we discussed. And more importantly and most importantly, access to new traffic and customers. This overall, any shop experience will be incorporated into the Weixin ecosystem.

And as a result, it would actually enjoy new traffic streams, such as it will have magnified access to our communication and social traffic, such as chat, group chat and moments as well as our media properties such as official accounts, media programs, search, video accounts and over time, recommendation engine. So the whole idea is that when we know what products are being sold by what merchants, then we are more comfortable in providing access to traffic to our consumers in the Weixin ecosystem. And that actually would create the flying wheel on the attraction for merchants.

Earlier attempts by Tencent to enter e-commerce on its own fell short as they realized fulfillment and logistics were not their strengths. Instead, they pivoted, becoming early investors in nearly all major Chinese e-commerce platforms except those of Alibaba, including Pinduoduo and Meituan, which grew with the support of the WeChat ecosystem. Now, Tencent is leveraging this same powerful ecosystem to build its own e-commerce platform—a move likely unsettling for competitors.

The synergy across Tencent’s units is clear: short videos fuel ad revenue, enhancing marketing services, while consulting fees and cloud services provided to merchants boost their FinTech and business services. This development aligns with Pony Ma’s long-stated vision of Tencent’s next big opportunity, now finally coming to life.

Capex and investments:

Tencent’s latest filing reflects a subtly more aggressive stance. They have increased R&D spending to RMB 17.9 billion, up 9% year-over-year, focusing on strategic areas like AI. Operating capital expenditures soared by 122% to RMB 14.7 billion, driven by significant investment in GPU services. In parallel, Tencent has been actively divesting from older investments, capitalizing on recent market rallies to recycle capital. This approach bolsters their net cash position, even amid ongoing share buybacks and dividends, creating “ammunition” for future strategic activities. Tencent also grew its workforce by 3% year-over-year, bringing its employee count to around 109,000, with the third quarter traditionally marking the peak of college recruitment. Together, these moves highlight Tencent’s evolving, proactive approach to innovation and growth.

On the Chinese Economy

If you’re wondering how to interpret the recent Chinese government stimulus, this is how Tencent is approaching it. Might be interesting for investors in general too.

We do get encouraged by the recent policy by the Chinese government to stimulus -- provide stimulus to the economy. And we felt this policy direction is very constructive. It's very timely, and the resolution is actually very strong. So that's why we are constructive on the longer-term economic outlook. We believe that the economic growth would eventually reaccelerate. Although the timing may be uncertain, and especially, it would take some time for the measures to be implemented and additional time for the measures to take effect. So how do we position ourselves? I would say we would continue to do the right things, right?

Tencent essentially stated that they can’t influence the macro environment, so they’re focused on doing their best regardless of whether times are good or bad. The impressive part is that, despite the widespread view of this being a challenging period, they still managed to grow revenue by 9% and increase operating profit by even more. One can only imagine what this would look like in a favorable macro environment. They also mentioned that, unsurprisingly, the third quarter was tough, but they’ve seen an uptick in October.

They go on further to say:

We believe, going forward, the economic recovery would take some time. But over the long run, we do believe it would definitely be reaccelerating because we felt there is a very strong resolution by the government to revive the economy. And at the same time, there's actually positive structural factors in the economy including a very strong work ethics among workers in China, including a very deep engineering talent pool, including entrepreneurism among companies of all sizes, small, medium and large companies. And also there is a vast and comprehensive supply chain in China, just to name a few.

Apologies for the many quotes, but I couldn’t have said it better myself, and it’s much more valuable to hear it directly from the team at Tencent.

Summary:

Tencent’s steady development is clear proof that what they project a few quarters out often materializes. Despite a tough macro environment, Tencent achieved 9% revenue growth and more than doubled operating profit, underscoring their resilience. The standout this quarter is the introduction of mini-shops, a major new step that could pose a serious challenge to current e-commerce players. Moreover, Tencent is optimistic about recent Chinese policy changes and stimulus measures, viewing them as supportive for future growth. This stability and forward momentum amid a weak economy signal a strong potential for Tencent if the macro environment improves.

1) "Now, Tencent is leveraging this same powerful ecosystem to build its own e-commerce platform—a move likely unsettling for competitors."

Tencent really only has one e-commerce competitor in China: 800 lb gorilla Alibaba. Tencent's efforts are directly aimed at weakening this historic rival. Based on the performance of Pinduoduo over the last several years, Tencent has done a pretty good job.

2) "a very strong work ethics among workers in China, including a very deep engineering talent pool, including entrepreneurism among companies of all sizes, small, medium and large companies. And also there is a vast and comprehensive supply chain in China"

Massive long term advantages for China. Can't imagine anyone in the West (besides Elon) working 996, let alone 997. It's considered an inhuman work schedule there.

Excellent summary of the results. Thanks.