Earnings Brief #1 Meituan ($3690.HK) and Pinduoduo ($PDD)

Meituan bows out, Pinduoduo is the last man standing

Meituan ($3690.HK)

Let me briefly introduce Meituan.

Though it may not be widely recognized outside of China, within the country, it's a household name. Boasting around 700 million active users, Meituan is deeply ingrained in Chinese daily life, capturing a significant portion of consumer mindshare. Its primary services include food delivery—offering not just meals but virtually anything you can think of, delivered to your doorstep within 30 minutes through instashopping. Additionally, Meituan has a strong presence in the hotel and travel sectors, an extensive in-store business, and several new initiatives. Frankly, I couldn't imagine life without Meituan (as I am writing this I am waiting for my food delivery from Meituan). Every time I glance out of my window, I spot a delivery person in a yellow jacket, bringing food to someone's door. And it's not just an occasional sight—it's every single time. It's truly astonishing.

But now to the earnings:

Before the earnings, the three core market concerns were: the slowing growth in food delivery, competition in in-store services, and losses in new businesses.

Spoiler - there were no bad news for the food delivery business and positive developments for both the in-store and new initiatives.

Let’s see the details.

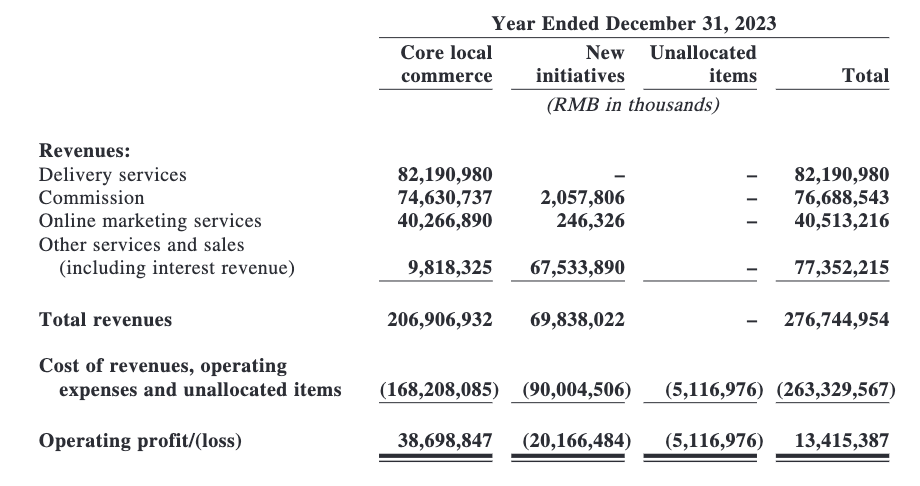

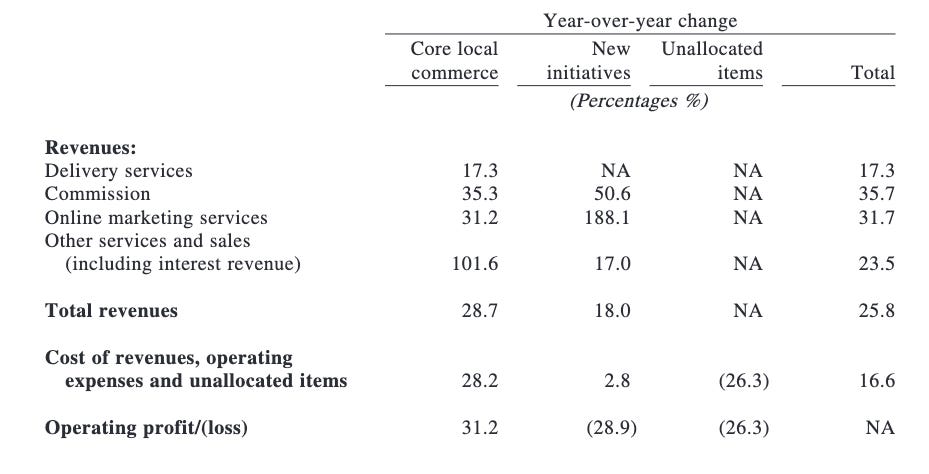

Core Local Commerce:

Continues to exhibit healthy growth, despite margin pressures from intensifying competition.

Food delivery did okay, but earnings growth (17.3%) was less than transaction volume growth (23.9%). Thanks to an abundance of drivers, cheaper delivery costs could be passed on to consumers without harming profits.

Instashopping is doing great with order volume increasing by over 40% year over year in 2023. Management was highlighting strong consumer stickiness and spending power.

At least no bad news coming from their delivery business.

In-store, hotel, and travel business performed very well, with growth in GTV: 100% increase year-over-year. Annual transacting users and annual active merchants grew by 30% and 60%, respectively. Travel within mainland China, in particular, has seen a strong rebound, similar to other travel platforms such as Tencent-backed Tongcheng Travel ($780.HK) and Trip.com ($TCOM).

Competition is fierce. Douyin, but now also Kuaishou ($1024.HK) and Xiaohongshu, are entering the local life service business, which has dragged down margins. Increased spending on promotions and vouchers has been a response.

Management views the competition partially positively, as it accelerates the digital transformation of the local life service business, which makes the TAM bigger for everybody. There is still significant room to expand the digitalization of local life services.

One KPI I look at is the gap in growth rates between advertising revenue and commission income. This indicator has been negative since 2022. However, this quarter, advertising growth (40.8%) actually surpassed commission income growth (32.7%) by 8 percentage points, marking the first time in two years. This reversal indicates that the competitive landscape for Meituan's in-store business may not have worsened further and might even have marginally improved.

So some good news from the in-store, hotel, and travel business.

Now let’s talk about the new initiatives.

New Initiatives:

Meituan's new initiatives excluding encompass a variety of businesses, including bike and power bank rentals, SAAS restaurant management, and B2B food delivery services like KuaiLy. Though individually they might not seem significant, collectively, they're instrumental in generating frequent user traffic and enhancing the platform's utility. These services are smartly integrated with Meituan's broader ecosystem, contributing to a holistic experience around Chinese eating culture, epitomized by the synergy with Dianping, Meituan's restaurant review and reservation service. As a group, these initiatives are on track to achieve cash flow positivity by 2024, representing a strategic milestone in Meituan's growth and operational efficiency.

And then there is Meituan select.

Meituan Select, the company's venture into the community group buying (CGB) sector, specifically focuses on e-commerce for fresh food and dairy. This has proven to be a challenging business. In 2023, Meituan Select was the significant factor behind a 20 billion RMB loss, underlining the difficulties inherent in this business model. With growth decelerating and an inability to rapidly curtail losses, management has had to make a strategic pivot.

Growth of Meituan Select (“美團優選”) slowed down in 2023, as the market size of community e-commerce was relatively flat on year-over-year basis. Despite the year-over-year efficiency improvement, Meituan Select still made significant loss with high operating loss ratio during 2023 mainly due to: 1) scale growth was slower than expected which made it difficult to meaningfully lower fulfillment cost per item; and 2) fierce competition which made it difficult to improve price mark-up ratio and lower subsidies. While Meituan Select is still part of our online grocery strategy, we admitted this market was much tougher than we originally expected. We will make strategic changes and refine the business model in 2024, aiming to significantly reduce the operating loss. We will prioritize on building key competences and improving user experience, rather than focusing on market share. We plan to increase the price mark-up ratio and reduce subsidies in the future, paying more attention to the long-term growth of natural retention rate.

This strategic shift has already begun to show promise. On the earnings call, management reported that losses from Meituan Select have been significantly reduced in Q1, indicating early signs of success from their revised approach.

Reducing their losses gives Meituan the leeway to allocate resources towards other growth initiatives:

Expansion and Globalization:

Lower-Tier Cities: Currently, many companies are expanding into lower-tier cities. With rising disposable income levels, these cities have become more attractive. However, this expansion won't be easy, as they will particularly have to contend with Kuaishou, which has a significant presence and consumer mindshare in these lower-tier cities.

Hong Kong: Last May Meituan launched its food delivery service, KeeTa, in Hong Kong. This venture represents Meituan's initial expansion beyond mainland China and is anticipated to serve as a foundation for further international growth.

Mergers and Acquisitions: During the earnings call, management strongly suggested that mergers and acquisitions would play a key role in expanding their food delivery business beyond mainland China. Building from scratch could be too time-consuming, and leveraging their substantial cash reserves could accelerate this international growth strategy. Their cash and cash equivalents total 145 billion RMB.

Final thoughts:

Finally, the management has addressed the significant losses incurred by their community group's business activities. Simultaneously, local life services appear to have stabilized.

I'm not aiming to provide a detailed valuation for Meituan here—that would require an entirely new article. However, considering their robust balance sheet, and even assigning zero value to the their CGB business and local life services, the valuation isn't exorbitantly high. I estimate the earnings from food delivery to be about 20 billion this year, which results in a 24x multiple when compared to their enterprise value. Would I buy Meituan right now? If it were the only stock available, yes, but currently, there are other great opportunities out there that appear more attractive, especially after Meituan’s recent price run up.

Pinduoduo ($PDD)

Pinduoduo is much better known in the West, and there are plenty of excellent analyses available (for example by Hayden Capital), so I'll spare myself the effort of providing a detailed introduction to their business.

As usual, the earnings report and call are as uninformative as possible, which freaks many people out. I hold a contrary opinion: I appreciate PDD's discretion in not disclosing too much information, as I believe it aims to keep competitors, not investors, in the dark. It's important to remember that they always enter markets with established players already in place. Therefore, in my opinion, withholding details on their strategies for market entry and how they are going to attack is a sensible approach. Rob Vinall also writes about that in his summary of Pinduoduo.

Now to the earnings - the growth numbers are insane:

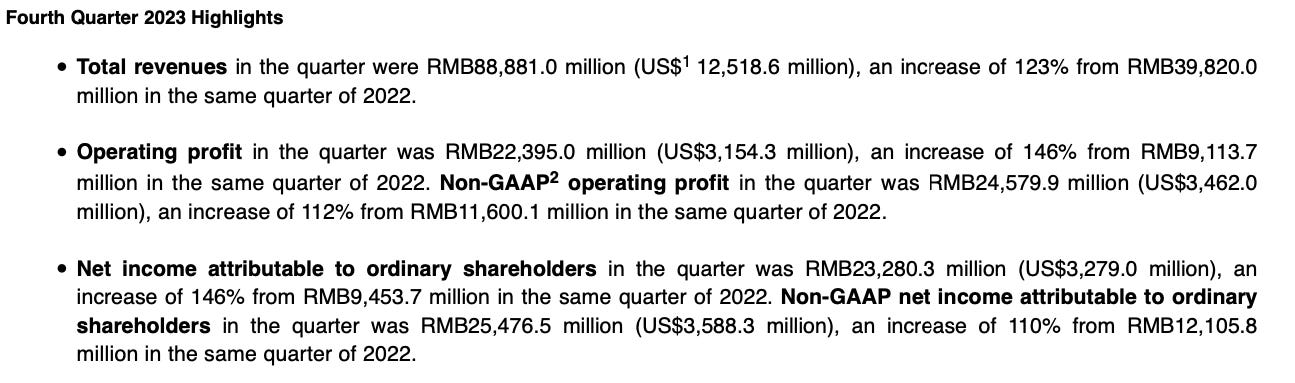

Fourth Quarter:

Pinduoduo experienced significant growth in the fourth quarter, with revenue up by 123% and operating profit increasing by 146%. This surge was supported by a 112% rise in non-GAAP operating profit and a 146% boost in net income attributable to ordinary shareholders, alongside a 110% increase in non-GAAP net income. This exceptional growth was driven by rising demand and positive consumer sentiment, with notable increases in revenues from online marketing services (57%) and transaction services (357%). The company also achieved operating leverage, reflecting efficiency improvements, although cost of revenue soared by 293% while operating costs rose by a more moderate 44%.

Full Year 2023:

For the full year of 2023, Pinduoduo reported a 90% increase in revenue, fueled by a 49% rise in revenue from marketing services and a significant 241% growth in transaction services. Cost of revenue saw a 192% uptick, but operating expenses only increased by 42%. These figures highlight Pinduoduo's robust growth and its effective cost management and revenue expansion strategies.

Let's talk a bit about the different segments. Essentially, they operate three businesses: their China e-commerce business through Pinduoduo, their community group buying business Doudou Maicai, and their international e-commerce business, Temu.

Pinduoduo:

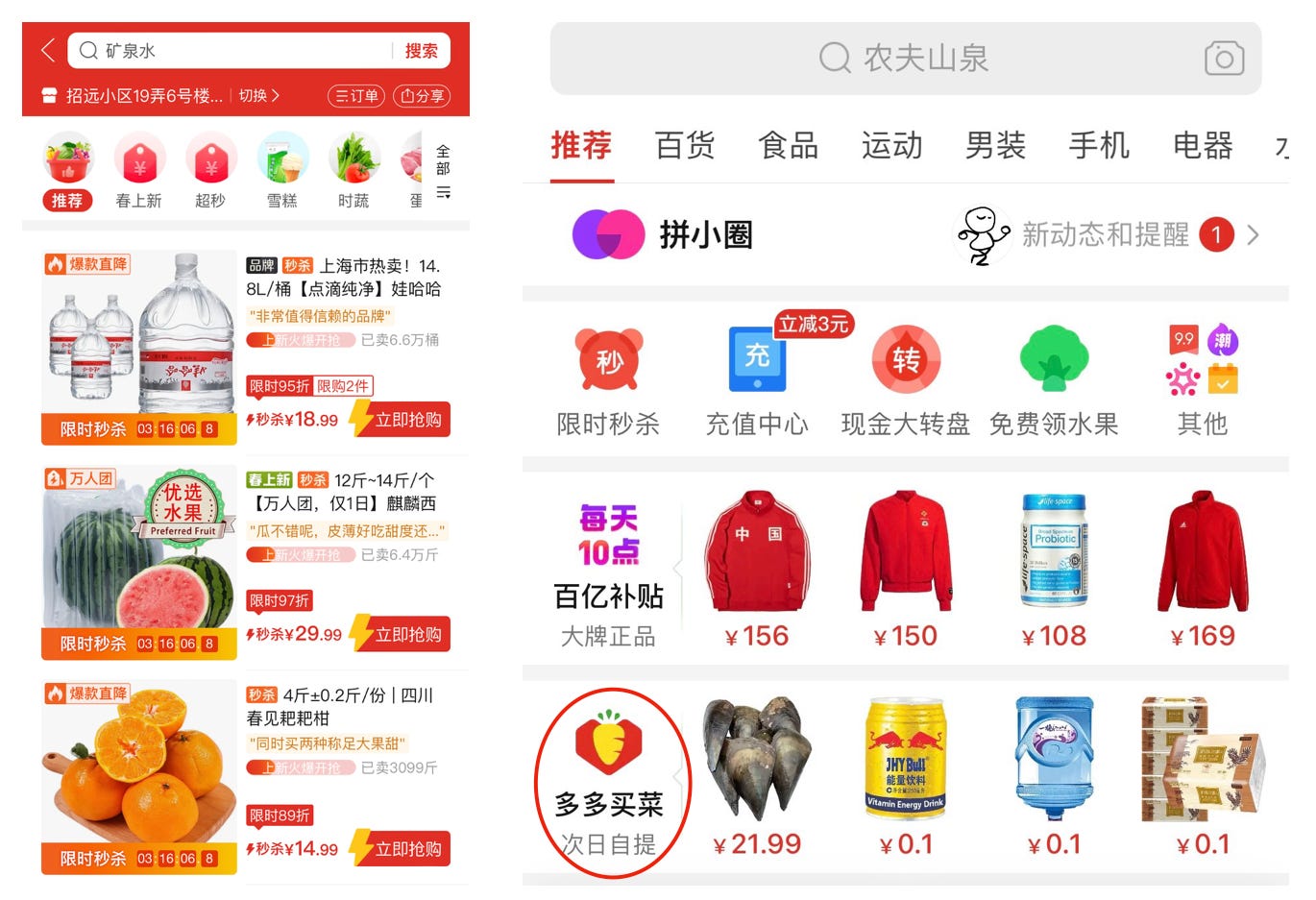

Pinduoduo entered the e-commerce scene when other huge players had already established their presence. Yet, they managed to become a significant force in Chinese e-commerce and are now emerging as the dominant player, instilling fear in their competitors—I'm looking at you, Jingdong and Alibaba. As the older generation of e-commerce players struggled to find growth and shifted their focus to asset-heavy strategies, Pinduoduo has once again proven that an asset-light e-commerce model is an unparalleled profit generator.

How did they do it?

Pinduoduo offers the cheapest goods among major domestic e-commerce platforms but also has the strongest monetization capabilities. Sounds like a paradox - how is this possible?

There are two reasons. 1) Most sellers on Pinduoduo make generic products, so Pinduoduo has more power to negotiate with them. 2) Pinduoduo makes all sellers promote their products in a way that turns free traffic from searches into paid traffic. Sellers go along with this because they usually don’t have their own customers or ways to sell, which means they can't argue much.

Personal experience:

Let me add some personal experience here. The mathematician in me is screaming "red flag, red flag, sample size of one," so take that with a grain of salt, or even a huge grain of salt. Pinduoduo’s customer service is far superior to Alibaba's and especially JD’s. Returning items is incredibly easy, and often, they don’t even bother to pick up the items you want to return. I had a similar experience with a Temu delivery while visiting my parents. Some people have found a loophole and return items they actually intend to keep, guessing they can keep them for free. This is a well-known issue among merchants I've spoken with, yet they say they still earn more money on Pinduoduo than on other platforms, even factoring in this 20% loss of goods. This really says a lot about Pinduoduo’s value.

Operating leverage at work:

Pinduoduo's operating profit for this quarter reached 22.4 billion RMB, an increase of 5.7 billion over the third quarter, despite the drag from Temu's losses. This is significant considering that the company's administrative and R&D expenses only rose by 700 million during this period while I heard that the group's marketing expenses for Pinduoduo's main site remained unchanged in 2023, effectively turning the 21 billion revenue increase into pure profit. The estimated profit for Pinduoduo's China e-commerce business is roughly 30 billion RMB in Q4. Also Pinduoduo's monetization rate has further increased, possibly reaching around 4.4%, marking a year-over-year increase of about 0.6 percentage points.

Delivery time:

A final comment I want to make is about delivery times. Actually, I'd be happy to hear your opinions in the comments and tell me if I'm wrong here. I don't believe that the longer delivery times for Pinduoduo are an issue. Based on my personal experience while shopping, there are two scenarios. Either I don't mind waiting an extra day or two to get a cheaper price, or if I need something urgently, I prefer to have it delivered immediately, not within 24 hours. In such urgent cases, I would opt for Meituan and have it delivered in 30 minutes. I don't see any scenario where the 24-hour delivery time, for example from JD, would be optimal for me.

Doudou Maicai:

This is their community group buying (CGB) business. Yes, you heard that right. It's exactly the business that corresponds to Meituan Select—the business unit I mentioned earlier that is now scaling back.

Let me give you a very brief summary of the community group buying business: In 2019, CBG was the hottest topic among Chinese tech companies. Essentially, all the major companies poured money into this business. All the tech giants clashed, including Meituan, JD, Alibaba, Didi, and others. Tencent did not enter on their own, but at that time, they had investments in JD, PDD, and Meituan, so collectively, they also had their stake in the CGB business. There is also a recent Tech Buzz China article worth reading about this topic.

These were not poorly managed companies; they were highly successful tech companies, steeled and experienced in battle, all now competing for the same market. It turned out that everyone was incurring losses and had to scale back operations, and in the end, only Meituan and Pinduoduo remained. Now, as Meituan is scaling back Meituan Select, Pinduoduo is the last one standing. This says a lot about the quality of their management if you can battle with the best tech companies and emerge as the sole winner.

It is rumored that Doudou Maicai is currently breaking even. Now, with Meituan scaling back, they possess even greater pricing power, allowing them to mark up prices and potentially turn this into their next significant earnings stream while continuing to invest in Temu.

Temu:

Now, let's discuss Temu, the cross-border e-commerce business. This platform is likely more recognized outside of China, particularly due to their Super Bowl advertisements. Currently, this business is making headlines, especially due to the political risks associated with operating in the United States, including potential import bans. I will not delve into the political aspects here. However, when valuing Pinduoduo, I still assign a zero value to Temu, just to be on the safe side. Nevertheless, there is significant potential for a big upside if it works.

Regardless, I want to share some promising news from a recent article published by Late Post.

According to data collected by the market analysis firm SimilarWeb, Temu's global unique visitor count ranks second only to Amazon. In the US, where Temu's business scale is largest, its monthly active users exceed 150 million, covering over 90% of US e-commerce users.

Moreover, LatePost reports that Temu is transitioning some responsibilities for overseas warehousing, freight, and returns to merchants through a semi-managed model. Analysts believe this strategy could substantially reduce Temu's loss rate, nearly two years after Pinduoduo initiated the Temu project. Around March this year, Temu implemented a semi-managed model in the US, with plans to extend it to major European locations. Under this model, Temu's merchants are responsible for shipping goods from China or elsewhere to the buyer's region, including managing overseas warehousing, distribution, and returns. Meanwhile, Temu focuses on pricing, marketing, and after-sales customer service to maintain a high-quality user experience.

So, you can see they follow their playbook again: initially, they absorb heavy losses while expanding their scale, followed by ramping up monetization and reducing costs to achieve high profitability. This exact strategy was applied to their Chinese e-commerce business as well as Doudou Maicai. And now they are beginning to reduce losses in their Temu business.

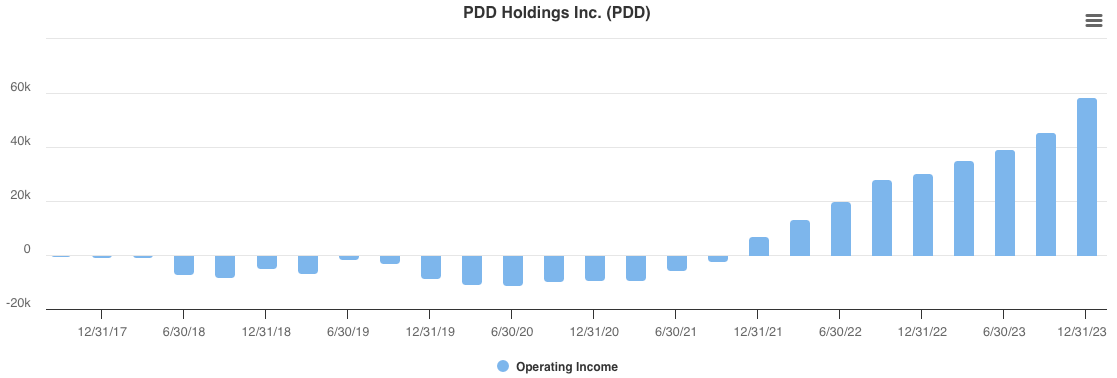

To understand their effectiveness in monetization upon reaching a large scale, consider PDD's Last Twelve Months (LTM) operating earnings. Note that the later figures include losses from both Doudou Maicai and Temu.

Final thoughts:

I'm not focusing on the management aspect—refer again to Hayden Capital for that. However, I personally consider them to be among the very best operators, on par with the teams at Tencent and ByteDance. To illustrate one point: the management is exceptionally cost-conscious and frugal. It's noteworthy that despite exhibiting explosive growth, their General and Administrative (G&A) expenses remained flat in 2023. They operate an e-commerce business with a Gross Merchandise Value (GMV) of 4.2 trillion, yet the company's administrative expenses for a single quarter amount to only 1 billion RMB.

This is my first earnings summary, which might have gotten a bit too long. I'm happy to hear your feedback, especially the negative ones, on how to improve. Let me know what you liked and what could be expanded upon or what to leave out.

Thanks for your time reading my article and subscribing. I appreciate it!

Thanks for the great summary of PDD earnings and business model. Given current price and mutliples, do you think it is fairly valued?

Thanks I enjoyed reading your posts and local perspective . “but currently, there are other great opportunities out there that appear more attractive, especially after Meituan’s recent price run up. “

Agree. Would you mind sharing yours to compare against reader’s .