Huya ($HUYA):

A quick overview of last quarter's numbers.

Q4 2023

Q4 Net Loss: 275 million RMB, improvement from 562.7 million RMB.

Q4 Non-GAAP Loss: 189.7 million RMB, down from 438.7 million RMB.

Q4 Monthly Active Users (MAUs): 85.5 million, stable.

Full year 2023

Full Year Revenue decreased 24.5%.

Full Year Net Loss reduced to 204.5 million RMB from 547.7 million RMB.

Full Year Non-GAAP Net Income: 119.1 million RMB, down from 290 million RMB.

User base constant year-over-year.

So much for the basic numbers, which didn't come as a big surprise. The drop in revenue had already been announced by management in their Q3 earnings due to their business adjustments. In the short term, these adjustments towards more in-game related services are expected to cause a decline in revenue, but in the long term, this should be a very positive development.

First positive signs are already visible, advertising and other revenues increased by 40.5% quarter-over-quarter and 29.2% year-over-year, showcasing growth in game-related services, which currently account for 12% of revenue. This segment also boasts higher margins than traditional live streaming.

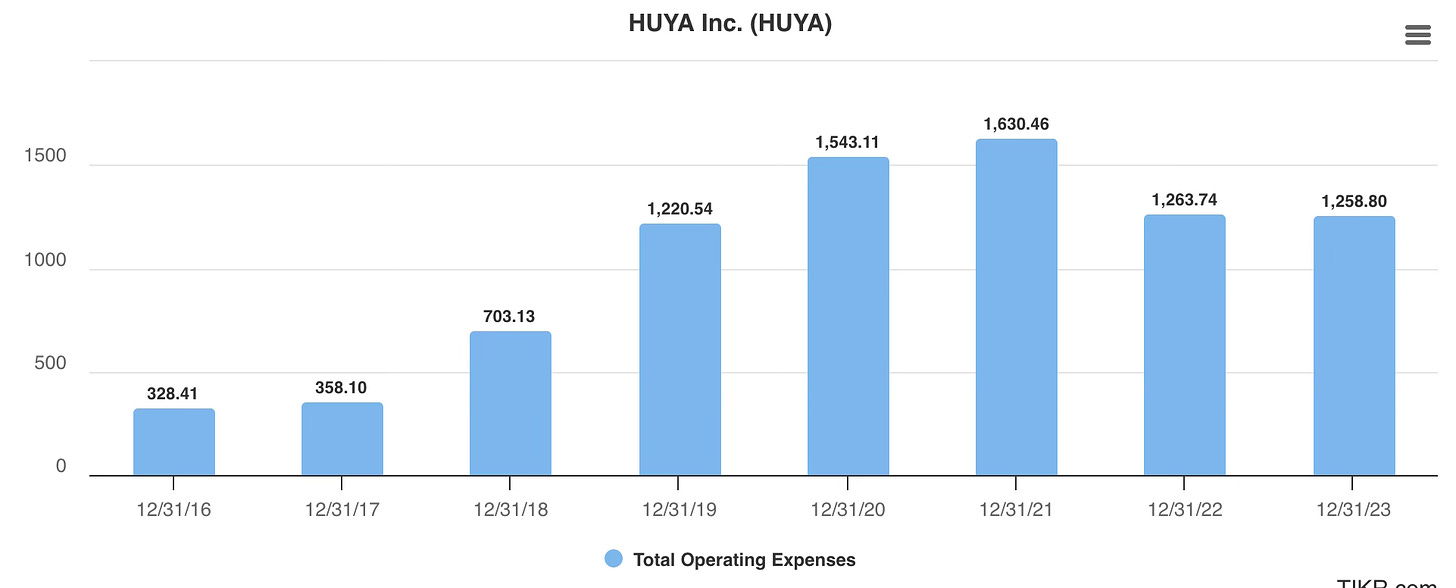

Another positive aspect of this transformation is that it can reduce operating costs:

Share buyback and dividends:

Already last quarter, they initiated a $100 million share buyback program, which is significant compared to the $1 billion market capitalization. Excluding the Tencent shares (Tencent owns currently 64% of the shares), with the $100 million, they can retire almost 50% of the float.

Now they declared a special dividend of 0.66 USD per share, totaling 150 million USD, which represents approximately 14% of the current share price.

If you pay attention to the numbers mentioned in the dividend announcement, you can perform a simple back-of-the-envelope calculation and determine that in Q1 2024, they bought back at least another 2% of the outstanding shares.

Given that China has capital export controls, this point from the earnings call was very significant:

In terms of distribution, the majority of our cash and cash equivalents are deposits held in our offshore accounts in US dollars. As we mentioned earlier, we expect the profitability level in 2024 to have further room for improvement compared to the year before. We also expect to achieve positive operating cash flow for the full year.

Let me provide you with some more background on the Huya situation:

Background:

Despite its recent price run up, Huya is currently trading at more or less exactly its net current asset value, equating to $4.50 per share.

On April 28, 2023 Tencent, the majority shareholder, acquired an additional 16% of Huya from Joyy Inc. ($YY) at a price of $5.73 per share.

Huya's stock, currently trading just at its net current asset value, coupled with Tencent's significant purchase at a 27% premium over the current price, points towards a safety net on the downside and a potential upside.

Huya, spun off from Joyy ($YY) a few years back, commands a strong position in China's live game streaming industry and is often compared to Twitch. Douyu ($DOYU), another platform operating in the same sector, is similarly owned primarily by Tencent. Intriguingly, it is trading at a mere 31% of its net current asset value. In January 2022, rumors circulated that Tencent might take Douyu private. A merger of these two streaming platforms could result in a monopolistic game streaming platform in China, echoing Twitch's dominance in the Western world. However, this proposed merger was initially blocked by China's State Administration for Market Regulation (SAMR).

Strategic importance for Tencent

The strategic significance of live-streaming platforms to Tencent cannot be understated. They provide an essential avenue for showcasing Tencent's extensive gaming portfolio, thereby driving user engagement and potentially boosting in-game sales.

Additionally, the booming e-sports market in China adds another layer of strategic relevance to Tencent's investment. E-sports is experiencing a boom in China, fueled by a rapidly growing, digitally-savvy youth demographic and significant investments by both the public and private sectors. Numerous Chinese cities are vying to establish themselves as the hub for e-sports in the country, further emphasizing the massive potential of this industry. Therefore, an integrated platform like a merged Huya-Douyu could be the cornerstone for Tencent to capitalize on the explosive growth of e-sports and fortify its stronghold in the Chinese gaming industry.

Recent macro development

The Chinese government, showing a change of heart towards the gaming industry, has recently issued more gaming licenses, known as "banhaos," at a steady pace. In addition, Tencent and other industry players have reported no new negative policies impacting the sector within the last year. On the contrary, the Chinese government is now acknowledging the crucial role of tech and platform companies in the country's economic development, signaling a potential rejuvenation of the gaming sector.

Changes made by Tencent after taking over control:

After the additional 16% purchase Lin Songtao a vice-president at Tencent, was named Huya's new chairman effective immediately, replacing Huang Lingdong who had held that post since April 2020.

The strategic focus is shifting towards game-related services, aiming to enrich its content ecosystem and strengthen its user base. Along Tencent’s strategy to phase out low margin businesses and replace them with high margin businesses even if revenue takes a hit short time.

Summary:

I consider this to be a great sidecar investment in the manner of Warren Buffett's friend and Harvard Professor, Richard Zeckhauser. You can purchase an asset managed by Tencent, one of the most outstanding operating teams in China, if not globally, at a price lower than what they paid for it just a year ago. One of the significant risks for this investment was always the possibility that Tencent might present a very low offer and take the company private. However, with the substantial number of share buybacks and the dividend, this risk has been significantly mitigated.

Joyy ($YY)

Q4 2023:

Net revenues: $569.8 million (down from $604.9 million in Q4 2022).

Net income to controlling interest: $45.8 million (improved from a net loss of $377.5 million in Q4 2022).

Non-GAAP net income: $64.2 million (up from $50.0 million in Q4 2022).

Full Year 2023:

Total net revenues: $2,267.9 million (down from $2,411.5 million in 2022).

Net income to controlling interest: $301.8 million (up from $128.9 million in 2022).

Non-GAAP net income: $292.5 million (up from $199.3 million in 2022).

Q4 2023 Operational Highlights:

Bigo Live's average mobile MAUs: Up 4.5% to 38.4M from 36.8M in 2022.

Total paying users of BIGO: Up 7.9% to 1.67M from 1.55M in 2022.

Average revenue per paying user of BIGO: $244.8, down from $251.3 in 2022.

Brief comment on the quarterly results:

I found this quarter's results underwhelming. One reason is the quarter-over-quarter decline in MAUs for Bigo. Furthermore, a closer look at the numbers reveals that the segment for Shopline (you have to dig a bit to find this hidden in the numbers) is also performing poorly. I had high expectations for Shopline, but there is scarcely any visible growth.

Background:

Nevertheless this is a very interesting company. It's a social media company that operates various mobile apps, most notably Bigo Live. They also have two other platforms called Like and Hago, but these are not as relevant. Additionally, they recently acquired a cross-border e-commerce platform, Shopline.

The company, headquartered in Singapore, operates its platforms exclusively outside of China. Previously, it owned YY Live, a platform dedicated to live streaming events in China, which Baidu ($BIDU) intended to acquire for $3.6 billion. However, the transaction was halted by the State Administration for Market Regulation and, after lingering in uncertainty for several years, Baidu retracted its offer, leading to the cancellation of the deal. Presently, Joy's market capitalization stands at $2.4 billion, substantially lower than the valuation at which this single subsidiary was to be sold to Baidu.

Joyy indeed aims to divest the YY Live business, seeking full independence from China. However, they're set to get back YY Live from Baidu, leading to significant market confusion. The future remains uncertain, yet educated speculation is possible. Given Baidu's operation of YY Live in recent years, they should at least return the earnings generated during that period. Moreover, YY Live still holds value, and although Joyy desires detachment from China, a reasonable sale price could be obtained, albeit unlikely to match the $3.6 billion initially offered by Baidu. Nevertheless, it retains intrinsic worth. My estimates suggest a fair value of about $60 per share, with current prices hovering around $30. For an in-depth analysis, there's an excellent article on Seeking Alpha. If interested, further details are available there, where the author proposes a price target of $75.

Summary:

Joyy is significantly undervalued. They demonstrate shareholder friendliness, regularly pay dividends, and, for instance, when they sold their 16% stake in Huya to Tencent, they promptly used the proceeds to buy back their own shares. However, I would not invest in the company at the moment simply because the market detests uncertainty. YY Live was operated by Baidu in recent years, and untangling this situation will be extremely painful and time-consuming, with an uncertain outcome. Therefore, until this issue is resolved and we have some clarity, especially since neither Joyy nor Baidu have reported on YY Live's numbers in the past few years, I don't believe the stock price will move much. However, once there is clarity, Joyy becomes a very interesting name to keep on your radar and potentially exploit this opportunity.

A bit like $1837.hk and $PEP PepsiCo

what do you think about Douyu, which is even much cheaper ?