How I Navigate the Chinese Stock Market Right Now

Cutting Through the Noise and Exploiting the Volatile Market

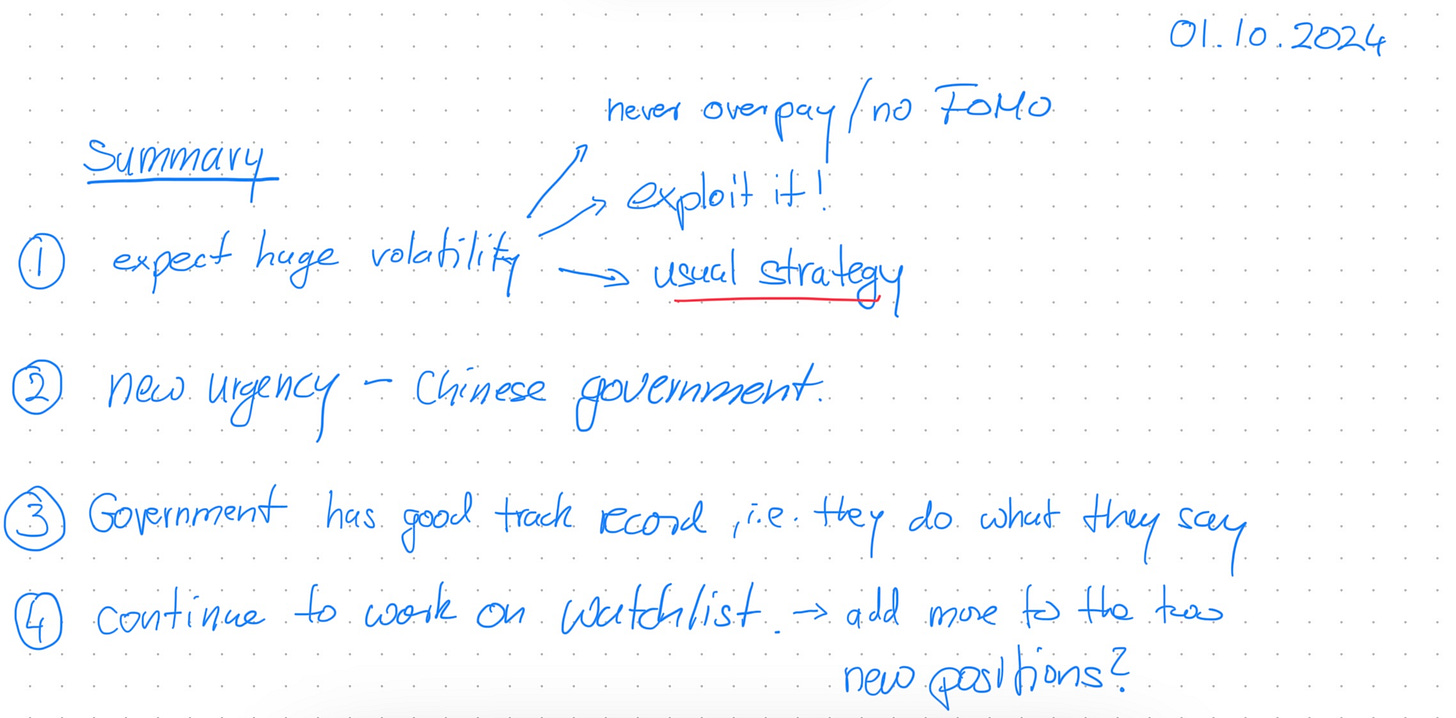

Introduction:

This week’s article will be a little different from the usual. I’m sharing a page straight from my investment diary. Although this entry is already three weeks old, I wouldn’t change a thing. China has been a whirlwind lately—press conferences rattling markets, sweeping policy announcements, and a flood of opinions from all directions. While I don’t usually focus on macroeconomics, when investing in China, politics and policies are critical factors you simply can’t overlook.

Simplicity is the ultimate sophistication.

Leonardo da Vinci

I could wrap it up here—that’s genuinely all you need to know. This framework represents the distilled essence of all the information I’ve absorbed and contemplated. Writing a lengthy, detailed analysis would have been the easy route, but frankly, I find deep dives1 overrated. While it’s important to consider a wide range of data and perspectives, the real intellectual challenge lies in boiling it down to the essentials—cutting through the noise and irrelevant details. But if you’re not able to simplify, then all those details will drown you when new information comes in. Often, a deep dive signals that someone wasn’t able or willing to pinpoint what truly matters.

Let me go through each point:

Expect huge volatility: It’s no genius insight that volatility will be high. The key is to be mentally prepared for it. Don’t overpay! The main factors driving this volatility include how the Chinese government communicates, the deeply depressed state of the stock market, and the fact that, for ADRs and H-shares, it’s largely non-Chinese investors driving the buying and selling. I’ve adjusted my strategy for investing in Chinese stocks—combining longer holding periods with taking advantage of volatility.

New urgency: I’ve already written about the mental model of the pendulum swing and how I view Chinese policies, so I won’t repeat that here. However, I firmly believe that the moments when the pendulum starts to slow down and reverse direction are where real opportunities lie—if you can spot them early. Right now, I sense a newfound urgency in the Chinese government with the latest policies aimed at stabilizing the economy, an urgency that wasn’t apparent just a few weeks ago.

Government is doing what they are saying: Reversing the direction of the pendulum without stability wouldn’t work. Another principle I rely on when analyzing Chinese government policies, which is deeply rooted in how the government operates, is their strong track record of following through on what they say. There are moments when they can instantly reverse direction by 180 degrees. Take, for example, the shift from zero COVID to full reopening overnight—that kind of drastic change can happen. However, once they reverse course, they maintain it for a while; it’s not a zigzag pattern. When they make a decision, they stick to it. And once they announce a policy, they follow through.

Work more on the watchlist: I shifted from a defensive position, with a large portion of my portfolio in cash, to gradually reversing that and buying stocks on my watchlist that were previously trading at inflated multiples but have now come down to attractive levels. I even added two new positions, which is significant for my typically very concentrated portfolio. I’ll probably write about these positions once I’m done buying.

I’m not calling for an all-in move. However, recent developments have led me to adjust some of the probabilities in my assumptions, making a few companies on my watchlist look even more appealing. That said, I still follow Walter Schloss’s approach: I don’t like to overpay, and I don’t like to lose money.

Going forward:

Looking ahead, I doubt volatility will settle down. There’s still a lot to watch. For one, third-quarter results may be very weak since any government announcements made in late September wouldn’t have impacted the quarter. Additionally, the upcoming U.S. election will have some influence. After introducing monetary measures, the Chinese government, or more specifically, the Ministry of Finance, has also discussed fiscal measures. However, no specific numbers have been provided yet, as these need approval from the National People’s Congress Standing Committee, which won’t meet until the end of October. Until then, we won’t see any concrete figures. So, while volatility is likely to remain high, we can still take advantage of it.

Summary:

The aim of this article wasn’t to provide a detailed discussion on everything happening right now—quite the opposite. There are plenty of excellent sources you can turn to for that. Instead, my goal was to go beyond simply presenting all the information and avoid overwhelming you with details. Instead, I wanted to distill it down to something more actionable that might help you going forward.

Points two and three essentially serve as the compass I’m using. As long as I don’t see any deviations from them, I rely on that to cut through the noise when people get worked up over government-reported numbers not meeting their expectations. These principles guide me. On the other hand, points one and four are more about being prepared and how I’m actively working on adding to my portfolio.

On an unrelated note, there’s a fantastic passage in Terry Smith’s book Investing for Growth where he humorously vents about the absurd jargon in investing circles. Phrases like “deep dive”—are we all scuba divers now?—and “granular” instead of just saying “detailed.” My personal favorite is when an analyst asks for “more color.” I can’t help but picture a three-year-old asking their kindergarten teacher for new crayons.

Thank you for sharing this! I appreciate how you highlight the importance of simplicity and mental preparation, rather than getting lost in unnecessary details. Looking forward to seeing more of your watchlist picks and how you continue navigating these times!

What's your take on Chinese market rn? Are you long with your positions?