Huya Pays Out a 25% Dividend - hints at more dividends to come

Huya Rewards Shareholders with a Massive $1.08 Per Share Dividend

Brief Update on the Huya Situation

I want to provide a brief update on the current situation with HUYA 0.00%↑. I’ll keep this short. For more background information, you can refer to my previous article on the subject.

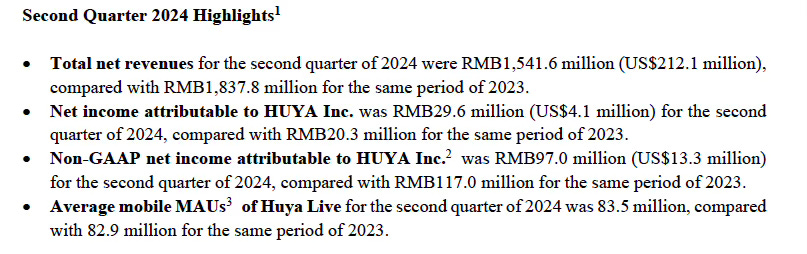

This quarter was relatively unspectacular, with the numbers very much in line with what management previously indicated, so no big surprises here. Here’s a brief summary of the key figures.

Another 25% special dividend

The big news was the announcement of another substantial dividend payout of $1.08 per share (approximately 25% of the current share price), following the $0.66 per share payout in May.

The board of directors of the Company has declared a special cash dividend of US$1.08 per ordinary share, or US$1.08 per ADS, to holders of ordinary shares and holders of ADSs of record as of the close of business on October 9, 2024, payable in U.S. dollars. The total amount of cash to be distributed for the special cash dividend is expected to be approximately US$250 million, which will be funded by surplus cash on the Company’s balance sheet.

Moreover, they continued to buy back shares and renewed the use of the unutilized quota under the existing share purchase program, amounting to an additional $43.3 million.

In the earnings call, they clarified that sufficient cash is held overseas to fund the special dividends and share repurchases.

As of the end of June this year, Huya held cash and cash equivalents and deposits totaling approximately RMB 8.2 billion equivalent to USD 1.1 billion, of which more than half were still overseas.

They also hinted at the possibility of further dividend payments in the future.

At the same time, we will continue to attach importance to shareholder returns, especially cash returns to shareholders.In terms of dividends, in addition to the special dividend of USD 400 million announced this year, the company's management also intends to continue to share the company's profits and surpluses with our shareholders who support us in the future.

In terms of shareholder returns, they are likely to prioritize dividends over share repurchases. One of the main reasons for this is that Tencent already owns more than 65% of the outstanding shares, leaving insufficient free float for significant share repurchases.

At the same time, we will continue to attach importance to shareholder returns, especially cash returns to shareholders

Business development:

Since Tencent replaced the previous CEO, the business seems to have stabilized, with paying users and monthly active users holding steady. While Huya may not be a great business, the last quarter was encouraging in that it showed no further deterioration of the live-streaming business.

A year ago, the Chinese government has increased its involvement in the live streaming sector, particularly by classifying the lucky draws provided by Huya as gambling, making them illegal. In response, Huya proactively adjusted its live streaming business, leading to a significant drop in live streaming revenue. However, after initiating these adjustments a year ago, the revenue from live-streaming has now stabilized quarter over quarter.

At the same time, following Tencent’s takeover, Huya’s new business focused on game-related distribution has shown strong growth. The revenue from this new business has grown by 152.7% year-over-year and 26.6% quarter-over-quarter, now accounting for 20% of total revenues. A year ago, Huya expected this new business line to contribute 30% of revenue within the next three years, so they are well ahead of schedule.

In addition, Huya is making good progress with its cost efficiency program. The new business unit, following Tencent’s recent strategy playbook, is focusing on higher gross profit margins rather than merely maximizing revenue.

Volatility of share price

The share price is quite volatile, which is advantageous as it has already provided several opportunities to buy and sell. One can sell when the stock price rises above what Tencent paid some time ago and repurchase when the price falls without any substantial new information.

How much did Tencent pay and what are approximate valuation metrics?

and what do you think about Douyu?

LV j