Introduction

A few years ago, the equivalent of the “Magnificent Seven” in the United States was the BAT stocks in China: Baidu BIDU 0.00%↑ , Alibaba BABA 0.00%↑ , and Tencent. These three companies were the top tech giants in China, leading the market and driving growth in the technology sector.

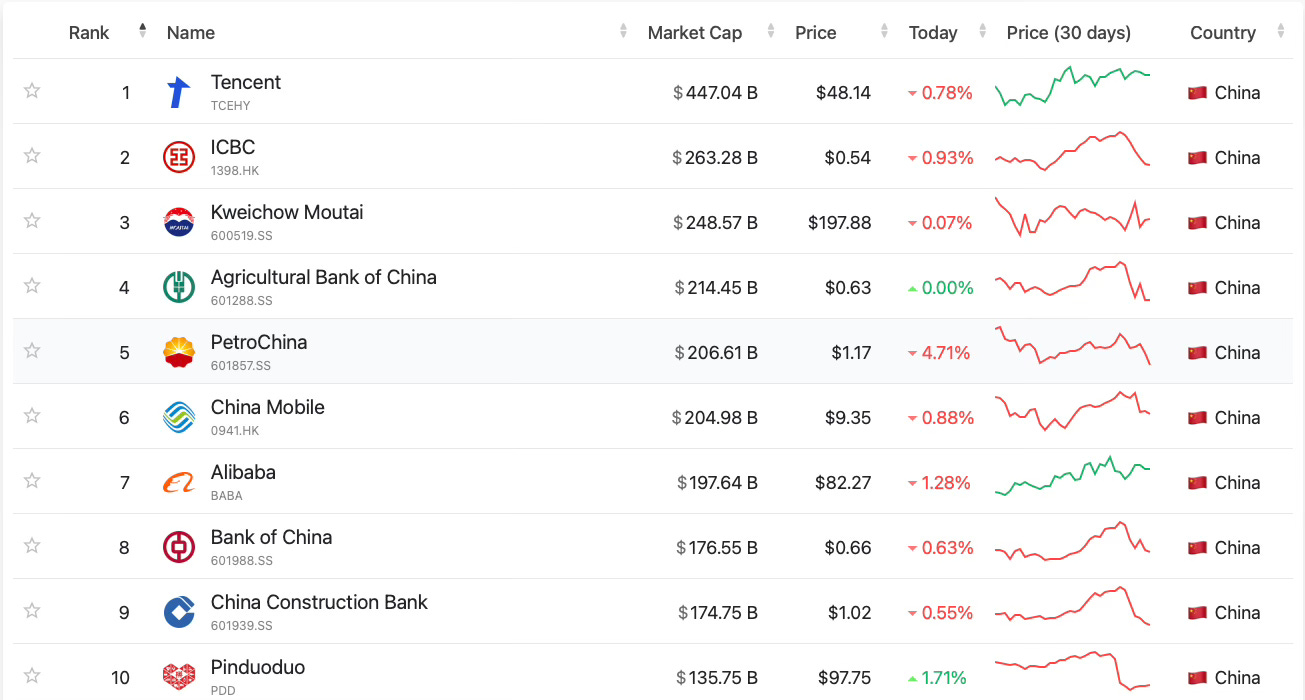

In recent years, Chinese tech stocks taken a heavy beating, but Tencent still holds the top spot in market capitalization by a large margin. Alibaba, despite its decline, ranks seventh, just behind major Chinese banks, Kweichow Moutai, PetroChina, and China Mobile.

Baidu, however, has fallen far behind. It now ranks 48th, just one spot ahead of Foshan Haitian Flavoring and Food, with a market cap that is only 6.7% of Tencent’s. This dramatic drop shows how far Baidu has fallen from its former position as a leading tech giant in China.

So, what is the reason for this decline, and is it justified?

Fundamentals:

On paper, Baidu appears very cheap. The company trades at a P.E. ratio of 11, with a forward P.E. of about 8. Additionally, Baidu has a strong balance sheet, with around 32% of its market cap held as net cash. These numbers suggest that buying a tech company with such cheap fundamentals could be a promising investment. It’s easy to understand why people might look at Baidu and think it’s a real bargain.

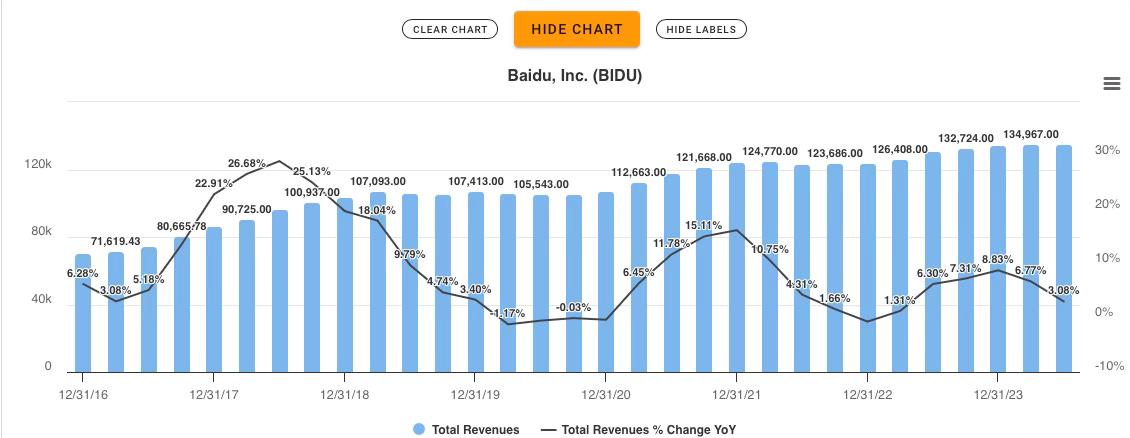

But when we look at Baidu’s revenue growth, there’s already reason for suspicion. Even before the tech crackdown, during the peak period for Chinese tech companies, Baidu’s growth was weak compared to its peers. While other major Chinese tech firms were experiencing rapid expansion, Baidu’s growth lagged behind.

The Illusion of Being the “Google of China”

When I talk to investors outside of China, I often see them trying to find a Western equivalent to frame their investments. Baidu is frequently compared to Google, and on the surface, this makes sense. Both started as major search engines, expanded into areas like maps with Baidu Maps and Google Maps, and are now involved in artificial intelligence—Google with Gemini and Baidu with ErnieBot. Both companies are also working on autonomous or self-driving cars. However, despite these similarities, the reality is very different.

Take, for example, the search engine business. While Google has established a near-monopoly outside of China, holding a dominant market share of about 90.48% globally, Baidu has never been able to achieve the same level of dominance in China. The search engine landscape in China is very different due to the presence of super apps like Tencent’s WeChat. Tencent and other companies made a strategic move by encouraging users to search within these super apps, gradually eroding Baidu’s market share. As a result, Baidu currently holds only around 61.11% of the search engine market share in China, significantly lower than Google’s dominance in other regions.

The Management Problem

The issue with Baidu’s management can be summed up by the saying in China:

起个大早,赶个晚集

which roughly translates to “Got up early but was late to the market.”

In my view, Baidu’s management team excels at identifying promising business opportunities earlier than many of their competitors. They are often the first movers in new markets or technologies. However, despite this early entry, they frequently fail to capitalize on their first-mover advantage. Over time, their competitors, with better execution and operating skills, tend to overtake them. This repeated inability to fully leverage early opportunities is a critical weakness in Baidu’s management.

Here are a few examples without going into too much details.

Healthcare Apps: Baidu Health was an early player, but it collapsed after a huge scandal in 2016. Meanwhile, Tencent Health, Alibaba Health, and JD Health continue to grow.

Self-Driving Cars: Baidu was one of the early entrants, but today it faces growing competition as more companies enter the autonomous vehicle market.

Travel Booking Site: Baidu couldn’t make Qunar, their travel app, work and ended up selling it to Ctrip. Today, Ctrip has surpassed Baidu in market cap.

Long-form Video: Baidu’s spin-off, iQIYI, has stagnated, now sitting at a market cap of around $2 billion.

Baidu Maps: Once the leader, Baidu Maps was overtaken by Alibaba’s Gaode (高德), which has since become the preferred choice for users in China.

Let’s discuss one example in a bit more detail.