Jiumaojiu $9922.HK Chinese hot pot chain

This is not a food blog like the last article!

This article continues my series on Chinese hot pot chains, although Jiu Mao Jiu is not a pure hot pot chain itself. You can find the first part here. Please note that the previous article had a more food-focused blog style, which received some criticism. In this article, I will concentrate on the business aspects, discussing food only when it is relevant to the investment thesis - I learned my lesson!

Overview and History:

Jiumaojiu International Holdings Limited, a player in the Chinese cuisine restaurant industry, traces its origins back to 1995 when the first noodle restaurant was established in Haikou, Hainan, by its founder, Mr. Guan Yihong. The company, initially focused on offering traditional Chinese dishes, began its journey with a vision to create a distinctive brand in the highly competitive Chinese culinary market. In 2005, the company made a strategic move by relocating its headquarters to Guangzhou and adopting the Jiu Mao Jiu trademark, marking a significant milestone in its expansion and brand development efforts.

The company’s growth trajectory accelerated with the opening of the first Double Eggs restaurant in 2010, followed by the rapid expansion of its restaurant network. By 2015, Jiumaojiu had opened its 100th Jiu Mao Jiu restaurant. The launch of the Tai Er brand in 2017 further diversified its portfolio, targeting the spicy foods segment and gaining nationwide popularity.

A key strategy employed by Jiumaojiu is its multi-brand and multi-concept strategy, designed to minimize internal competition and cannibalization. The company embraces a trial-and-error method, opening multiple brands and closely monitoring their performance to identify those that gain traction. This innovative approach allows Jiumaojiu to stay agile and responsive to market trends, ensuring that only the most promising concepts are scaled up. Notable brands under its umbrella currently include Jiu Mao Jiu, Tai Er, Song Hot Pot, and Lai Mei Li Grilled Fish, each catering to different segments of the market and enhancing the company’s overall market presence. Brands like Double Eggs, Cooking Spicy Kebab, Bravo Sirloin, Coconut House, and Happy Mouth were closed due to underperformance, highlighting the company’s commitment to focusing resources on the most successful and scalable concepts.

Jiumaojiu International Holdings Limited operates a total of 726 restaurants across various brands, showcasing the success of their expansive growth strategy. The brand breakdown includes 578 Tai Er restaurants, 62 Song Hot Pot restaurants, 68 Jiu Mao Jiu restaurants, and a smaller number of other brand restaurants such as Lai Mei Li Grilled Fish and Fresh Wood.

In January 2020, Jiumaojiu International Holdings Limited was listed on the Hong Kong Stock Exchange under the ticker $9922.HK. As of December 31, 2023, the founder of Jiumaojiu International Holdings Limited, Guan Yihong, owned approximately 37.33% of the company’s shares through controlled corporations.

Competitive Landscape:

It’s incredible how easy it is to find amazing food in China. Delicious meals are available everywhere, often at very low prices. The market is extremely competitive, and successful concepts are quickly replicated. Recently, I visited a popular Spanish restaurant on the Pudong side of the Huangpu River, and a few weeks later, another Spanish restaurant opened next door, offering exactly the same dishes. The competition is intense, as there are hardly any barriers to entry. Generally, the average lifespan of a restaurant concept in China is approximately 18 months.

The Chinese restaurant market is highly fragmented, with competition from domestic and international brands like Yum China Holdings, McDonald’s, Jollibee Foods, and Haidilao International. It is expected to grow to USD 939.32 billion by 2029, with a CAGR of 7% from 2024 to 2029.

Growth drivers include rising disposable incomes, rapid urbanization, more fast-food chains, and the influence of Western dietary patterns. Digitalization and social media also significantly impact market dynamics.

Consumer preferences in China are evolving rapidly; what is popular today might be outdated in a few weeks. There is a growing trend towards theme-based restaurants offering unique dining experiences, which Jiu Mao Jiu is capitalizing on with their concepts that target younger generations - see the first part of this article series for details. This trend is driven by younger consumers seeking novelty and memorable experiences. Additionally, the demand for prepared or on-the-go food is increasing, reflecting busier lifestyles and the need for quick dining solutions.

Chinese consumer spending:

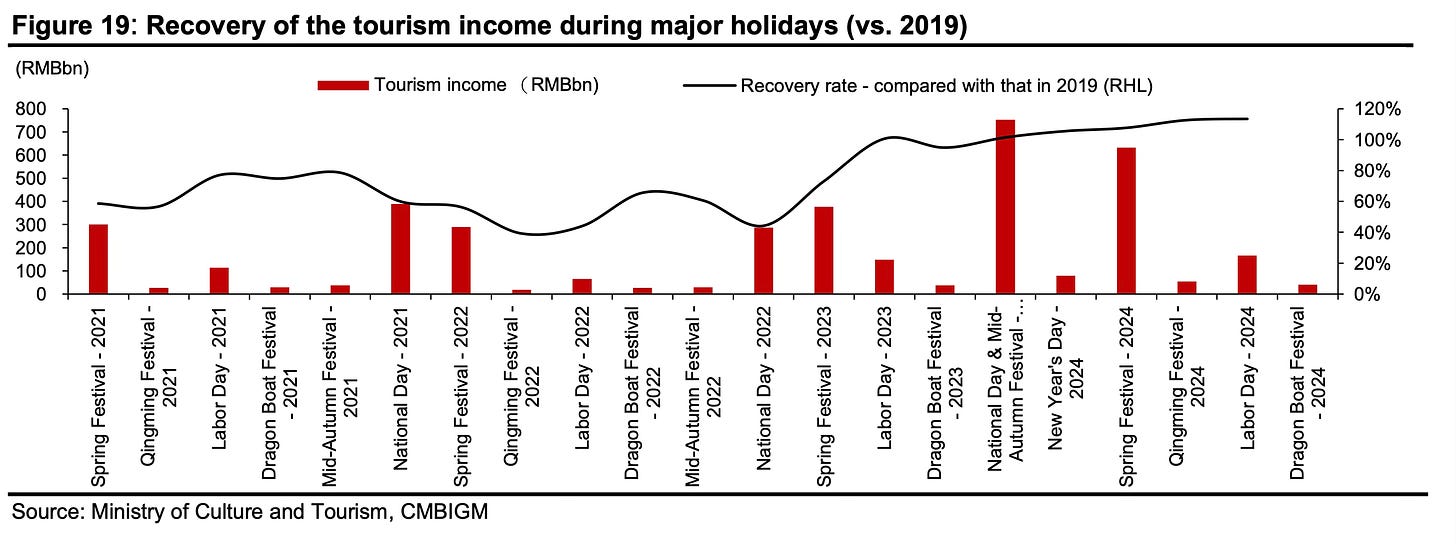

Chinese consumer spending has faced significant challenges in recent years, marked by a cautious approach to expenditures. Despite some signs of recovery earlier in the year, consumer confidence has remained low. The savings rate is significantly higher than pre-COVID levels, reflecting consumers’ preference to save rather than spend amid economic uncertainties and weak consumer confidence.

Chinese consumer spending shows an uneven growth pattern, with some sectors like real estate struggling while others, such as restaurants and travel, are thriving. The restaurant sector has experienced robust growth, partly driven by a rebound in domestic travel and socializing.

While people are more focused on their well-being and enjoying dining out, they are also mindful of their spending. Many consumers opt for eating out more frequently but prefer to spend less, leveraging discounts and promotions to manage their expenses efficiently.

This behavior is evident in the unit economics of the stores I will discuss next. It is also generally seen in areas such as e-commerce, where low prices are the main focus.

Unit economics of stores

Here is a broad overview comparing their 2023 numbers to their 2022 figures for the various chains Jiumaojiu operates.

Ok let’s go through the different chains one by one.

I start with their name giving brand Jiu Mao Jiu.

You can clearly see that COVID-19 had an impact, leading to a reduction in the store count for this chain by almost 50%. At the same time, the KPIs for Jiu Mao Jiu are much weaker than for their other two brands, Tai Er and Song Hot Pot. This is evident from the lower seat and table turnover rates coupled with the lower average spending per customer.

Although management is trying to tweak the concept to further increase the gross profit margin by streamlining operations, automatization, reducing staff costs as a percentage of sales, and introducing new store formats with a size reduction to 250 square meters, they still don’t plan to open any new Jiu Mao Jiu restaurants in 2024. I wouldn’t be surprised if they eventually wind down this chain as they have done with others before. Therefore, I won’t spend much time discussing the Jiu Mao Jiu chain.

Let’s move on to their main brand, the sauerkraut fish brand Tai Er.

You can clearly see they’re successfully scaling the number of restaurants. In 2024, they plan to open an additional 80 to 100 new Tai Er restaurants in mainland China and 15 to 20 new ones outside of China. However, while seat and table turnover rates have increased compared to 2022, they are still far from their peak popularity in 2019, when there were long lines in front of the stores and significant hype. One reason could be the increase in the number of stores, leading to some self-cannibalization. (See the risk section for an estimate of the possible number of Tai Er restaurants)

Nevertheless, a table turnover rate of 4 is already quite good. However, for this food concept, it might be slightly improved, as meals are fast to consume. In any case, I currently doubt that they can improve table turnover rates, and future same-store sales will need to rely heavily on average spending per customer, which is also unlikely to increase. Therefore, same-store sales will not grow substantially, if at all.

Let’s move on to the reason I included Jiu Mao Jiu in my Chinese hot pot series in the first place - Song Hot Pot.

Song Hot Pot is their latest brand, launched in 2021 and now being scaled up as it has become profitable after the COVID-19 lockdowns. Management has high hopes for this brand and plans to open 35 to 40 new Song Hot Pot restaurants in mainland China.

This brand is part of the highly competitive Chinese hot pot market, which includes major players like Haidilao and XiabuXiabu that I will discuss in later articles.

While the table turnover rate of close to four is quite good, I doubt it can increase much more, as eating hot pot takes a lot of time. Therefore, the table turnover rate for this food concept is more limited than for others. Recently, average consumer spending for this brand has declined, mirroring recent Chinese consumer spending trends. Since the table turnover rate is limited, future same-store sales will need to come from a rebound in average consumer spending. Additionally, management is trying to increase gross profit for Song Hot Pot through centralized procurement and reduced staff costs.

Average spending per customer and same store sales:

Their business development aligns with general Chinese consumer spending trends. Average spending per customer is down, but table turnover rates and the number of customers have increased. As table turnover rates have already bounced back from COVID-19 lows, I believe that future same-store sales growth will depend more on the willingness of Chinese consumers to spend more. I don’t see that happening right now, as people are price-sensitive and trying to reduce spending.

Food delivery:

Let me make a final remark on food delivery, which is huge in China. The concepts of Tai Er with sauerkraut fish and Song Hot Pot are not suitable for delivery and will never be able to increase their delivery sales. I often order from Meituan and while I like both chains, I would never consider ordering from them, as hot pot and sauerkraut fish are simply not suited for delivery.

Outlook 2024 - expansion plans

Expansion Plans for 2024

The company’s growth strategy for 2024 includes significant expansion plans, with a focus on their most successful brands. They aim to open 80-100 new Tai Er restaurants and 35-40 new Song Hot Pot restaurants in mainland China. Additionally, they plan to introduce 15-20 new Tai Er restaurants outside of China, marking their intention to strengthen their international presence.

The average cost to open a new Tai Er restaurant is approximately RMB 2.3 million, while for a Jiu Mao Jiu restaurant, the cost ranges from RMB 2.4 million to RMB 2.7 million. The average cash investment payback period for a Tai Er restaurant is 10 months, whereas for a Jiu Mao Jiu restaurant, it is 22 months.

You can clearly see why Tai Er is the growth driver for Jiu Mao Jiu. The payback periods are excellent. In contrast, payback times for Jiu Mao Jiu restaurants are much longer. Coupled with weaker unit economics per restaurant, it’s clear why there will be no new Jiu Mao Jiu restaurants.

Refining Business Models: Multi-Brand and Multi-Concept Innovation

The Lai Mei Li Grilled Fish brand will undergo further refinement of its business model before it is ready for network expansion. They follow a trial-and-error strategy, observing what gains traction and striving to perfect their restaurant concepts before scaling them up. The table turnover numbers for Lai Mei Li already look promising.

Franchise and Cooperative Models

To support their expansion and diversify their portfolio, the company plans to invest in catering service industry companies and implement franchise models for their Tai Er and newly developed Shanwaimian brands. The Shanwaimian brand will serve sauerkraut hot pot (I guess by now you see sauerkraut is key here). The Shanwaimian franchise model is specially designed for Chinese shopping malls and is set to launch in February 2025. The Shanwaimian brand caters to a very distinctive niche and taste and also takes into account the current environment where people look for value for money.

Restaurant franchising in China, although present for some time, has only recently been embraced by larger operators.

Initially, many companies, especially large Western chains, hesitated to adopt the Chinese franchising model due to quality control concerns. When they did, they preferred large master franchise agreements, partnering with a few major players nationwide or in key regions.

As China’s restaurant industry has matured and more skilled operators have emerged, many chains now use franchising alongside independent stores, or exclusively, to drive growth. Yum China (YUM) (9987.HK), recently began franchising after three decades of self-operating its stores. Bubble tea chains like Hey Tea, Nayuki (2150.HK), and Mixue Bingcheng have also started franchising.

Valuation:

Between 2019 and 2023, revenue grew at a 22.2% CAGR, despite huge fluctuations due to COVID-19. I built a financial model assuming the addition of approximately 100 new Tai Er restaurants and 35 new Song Hot Pot restaurants, aligning with current management outlook and slightly below 2023 numbers. (Take these growth projections with caution—refer to the risk section for my estimates for the potential total number of stores in China)

I assumed the JiuMaoJiu brand remains flat and did not account for contributions from new restaurant chains. I excluded any potential revenue from the franchise model as its effectiveness is unproven. For the new Shanwaimian Sauerkraut Hot Pot chain, I assumed no contribution due to mixed customer feedback and lower ratings on Meituan and Dianping compared to Tai Er and Song Hot Pot.

Given these assumptions, a 20% revenue growth over the next couple of years is achievable. However, as I point out in the risk section, I have serious doubts about these store opening numbers.

As I outlined above, I don’t believe there will be same-store sales growth going forward. Tai Er and Song Hot Pot already have high table turnover rates, and for the the Song hot pot chain, increasing this is difficult due to the long time it takes to consume meals. Additionally, given current consumer spending habits, it seems unlikely that average consumer spending will increase substantially. Therefore, growth will not come from same-store sales. Growth will mainly have to come from new stores.

Moreover, due to the economic downturn, reduced consumer spending, and fierce market competition, I believe margins will be under pressure, necessitating increased use of vouchers, discounts, and similar incentives. However, Song Hot Pot margins might still improve slightly as they are just beginning to fully roll out the chain concept, potentially bringing them closer to the margins of Tai Er and JiuMaoJiu.

Although revenue and earnings grew significantly during COVID-19, the stock is currently down 90% from its high in February 2021. When considering the PE ratio, the current valuations appear modest, both compared to peers and historical valuations, with a PE ratio of 10 and a forward PE ratio of 8.

Caveat:

It’s important to note that although the price-earnings ratio is used by the analysts who cover this stock, it is not an appropriate metric to consider here. A substantial portion of the rental costs for the stores is categorized as finance leases rather than operating rentals. Under current accounting standards, these finance lease costs do not directly impact earnings but are reflected in the cash flow statement. Currently, the finance lease cost per restaurant per year is approximately 750,000 RMB - albeit lower than in previous years. Including the financial lease costs they are cash flow negative.

Shareholder returns:

They announced a 200 million HKD share buyback program, representing about 30% of the current market cap. From mid-June to early July alone, they bought back 1.3% of the outstanding shares. The current dividend yield is approximately 4%, and they announced a forward dividend payout ratio of at least 40%.

Risks:

Limit on the number of new Tai Er restaurants:

One of my main concerns is that the potential number of Tai Er restaurants is significantly lower than initially anticipated.

Let’s make a simple Fermi estimate:

The average size of Tai Er restaurants is between 200 to 300 square meters, accommodating approximately 110 guests with around 33 tables. The seat turnover rate is 3, meaning one restaurant serves about 120,000 customers per year (of course, we are double counting if people come several times).

I estimate that people on average go there three times per year, similar to other chains. So, one restaurant will serve approximately 40,000 individual customers. As of writing I found found 65 Tai Er restaurants in Shanghai on 高德 (Alibaba’s map service). This implies there are about 2.6 million individual customers in Shanghai, which has a population of roughly 30 million. In other words, 8.7% of the Shanghai population are Tai Er customers.

For me, that sounds about right. The Tai Er concept is very special. This restaurant essentially serves one dish: spicy sauerkraut fish, with only some smaller side dishes available. If you don’t like sauerkraut fish (here is a picture if you have never seen it), you don’t go there. Given the unique taste and lack of variation—you will always eat the same main dish—I don’t see much improvement over the 8.7%. Ten percent, sure. Twelve percent, maybe. But I can’t see them doubling in Shanghai. So, growth must either come from lower tier cities or the ceiling is lower than expected.

Let’s triangulate the potential number of Tai Er restaurants in China differently. China has a population of 1.412 billion, with an urbanization rate of 65%. Out of those 910 million people, about 700 million live in Tier 1, Tier 2, and Tier 3 cities. Assuming Tai Er attracts 8% of the Tier 1-3 residents as customers, and each restaurant serves 40,000 unique customers, the ceiling would be 1,400 Tai Er restaurants in China. Currently, there are 578 Tai Er restaurants. While this suggests significant growth potential, I highly doubt they will achieve the same penetration in lower-tier cities as in Shanghai. Additionally, since they cater to a younger clientele, the probable number is much lower, likely less than 1,000. In any case, for many chain concepts, 1,000 restaurants seem to be a difficult barrier to cross.

Given that the main driver for growth for Jiumaojiu is the Tai Er restaurant chain, which essentially serves one main dish, this is quite risky. All eggs in one basket.

Franchising:

One significant risk with franchising is that Jiu Mao Jiu lacks experience in this area. They attempted it with their Double Eggs brand, aiming to open over 300 restaurants, but the effort failed, and the brand was closed down in 2022.

Additionally, I am very concerned about the quality of franchisees in China. Quality control is already a challenge outside of China, and my concerns are even greater within the country. If in doubt, franchisees will prioritize profit over the company’s reputation. This is even a bigger concern for Haidilao, whose success heavily relies on exceptional customer service. Here is an example of Mixue Bingcheng, which primarily relies on franchising for rapid expansion.

Moreover, there is still a shortage of good franchisees, and with more brands adopting the franchising model, competition for quality franchisees is intense. Therefore, the success of this strategy is uncertain, both due to quality control issues and Jiu Mao Jiu’s lack of franchising experience.

Moreover, while the franchise model allows for capital-light expansion, I argued that the potential number of restaurants might be very limited. This raises doubts about the viability of the franchise model, especially considering that profits from franchise stores are lower than those from self-operated stores, despite being more asset-heavy.

Increased Competition in China’s Restaurant Industry:

The restaurant industry in China is witnessing a significant surge in competition. This trend is evident across various chains, ranging from hot pot restaurants to international giants like McDonald’s and Yum Brands China, all of which have initiated aggressive expansion plans. While this is certainly good for some companies, for others growth will hurt them. For example, Haidilao, which I will discuss next in this series, had to aggressively scale back after their last expansion efforts. McDonald’s plans to have over 10,000 restaurants in China by 2028. At the same time, Chinese supermarkets, including Alibaba’s Freshippo, sell cheap fast food to attract customers, which is very well received.

Connected party transactions:

One must always be cautious about questionable connected party transactions with Hong Kong stocks. While this company is better than other restaurant chains, there was still a loan to the founder of the company for RMB 80.7 million at the very low interest rate of 2.6%. The loan was fully repaid in October 2023.

Summary:

Jiumaojiu is a multi-brand, multi-concept restaurant chain in China, best known for their Tai Er spicy sauerkraut fish restaurants, and increasingly for their Song Hot Pot restaurants. The Tai Er brand has shown impressive traction, growing rapidly even during the COVID-19 pandemic. Despite this growth, the stock price has collapsed by more than 90%. Currently, the company trades at a PE multiple of 10 with a dividend yield of 4%, however they are cash flow negative. They have also announced a share buyback program worth 200 million Hong Kong dollars, which is approximately 30% of the current market capitalization. However, I have serious concerns about same-store sales, the lower ceiling for the number of potential stores, and whether the company can develop new successful concepts or expand through franchising.

Given the financial lease cost, which includes their rental expenses, they are not cash flow positive. This makes the earnings figures somewhat misleading. Considering this, I prefer to take a passive stance and wait. I want to first see what happens with same-store sales and whether they can open more Tai Er stores without self-cannibalization.

News after writing this article:

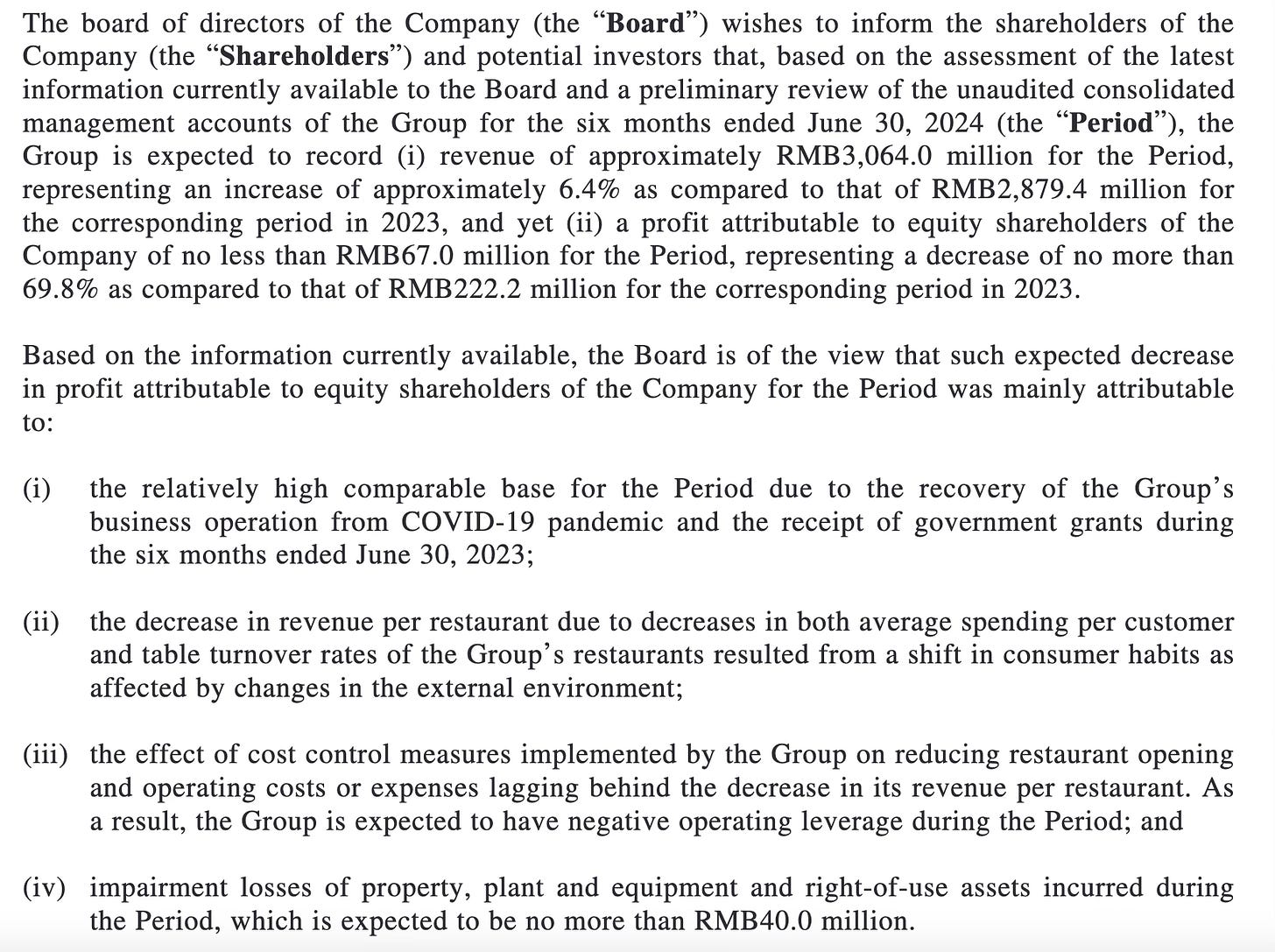

This article was already written in its current form, and I was just waiting for the investor relations team to respond to some questions before publishing it. Since I am currently traveling in Europe, we couldn’t have a call and agreed that I would ask them questions in written form. Their initial response was very quick, but now that I’ve asked them concrete questions, they have disappeared. Today, I found out they are issuing a profit warning.

Profit Warning:

Additionally they released their operating numbers for Q2 2024:

In 2Q24, Tai Er, Song Hot Pot, and Jiu Mao Jiu had table turnover rates of 3.6x, 2.8x, and 2.6x respectively, a decline from 3.9x, 3.0x, and 3.0x in 1Q24. Their same-store sales also fell by 18%, 37%, and 13% year-over-year in 2Q24, compared to declines of 14%, 35%, and 4% in 1Q24. The average spending for customer in 2Q24 were RMB 69 for Tai Er, RMB 104 for Song Hot Pot, and RMB 55 for Jiu Mao Jiu, down from RMB 75, 121, and 59 respectively in the first half of 2023.

These numbers are worse than expected, which indicates a challenging landscape. With many competitors and other restaurant brands aggressively expanding, the competition is fierce. Opening new restaurants might lead to some self-cannibalization due to a lower-than-expected ceiling of potential restaurants, and weak Chinese consumer spending is decreasing same-store sales.

A favourite short on the street

As big of a fan I am of their food, the stock is a hard pass for me.