Recent Developments in China’s Tech Landscape: The Winners and Losers

How Open Competition is Reshaping the Market, Empowering Consumers, and Putting Pressure on Weaker Players

China’s tech industry is undergoing significant changes, marked by moves towards self-regulation and the breakdown of long-standing digital barriers. These shifts are reshaping the competitive landscape and altering how major platforms interact with each other and their users. Who will profit from these changes, and who will lose out?

Government-Mandated Self-Regulation: Reshaping Compliance in China’s Tech Industry

Late in August, five major platform companies in China signed the "Convention on Self-Regulation of Compliance in Online Transactions" in Beijing. This agreement represents a coordinated effort to address compliance issues in online transactions. The convention focuses on implementing platform responsibilities, protecting consumer rights, prohibiting unfair competition, regulating pricing behavior, and enhancing government-enterprise collaboration. This move towards self-regulation reflects the growing pressure on China's tech giants to adopt more transparent and socially responsible practices.

In the Aftermath of Self-Regulation, Things Are Moving Fast in China’s Tech Industry

The self-regulation agreement at the end of August was followed shortly by Pinduoduo’s PDD 0.00%↑ now infamous earnings call, I have written about it here and here. Pinduoduo moved quickly to implement changes. The platform began refunding service fees to some merchants and kicked out low-quality sellers, reflecting the growing pressure on platform operators to improve business practices in light of the upcoming regulations.

Taobao has recently integrated WeChat Pay as a payment method, marking a significant shift in the long-standing rivalry between Alibaba and Tencent. By September 2024, consumers will be able to use WeChat Pay for purchases on Taobao, streamlining the payment process and reducing the need for multiple apps.

Meituan has made its food delivery and hotel booking services available through Alipay’s mini-programs, showing how major platforms are breaking down digital barriers and increasing interoperability between previously competitive ecosystems.

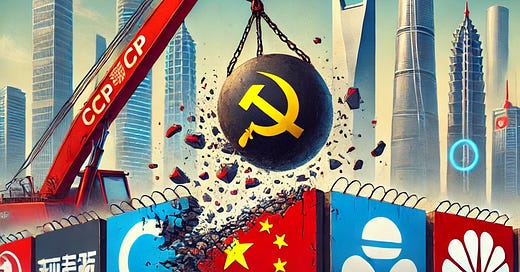

The Ongoing Destruction of Walled Gardens in China’s Tech Industry

These developments coincide with the ongoing destruction of “walled gardens” in China’s tech sector. Historically, major internet platforms operated as closed ecosystems, limiting interoperability between services. However, regulatory pressure, which started back in 2021, has forced tech companies to break down these barriers, leading to more openness and cooperation.

Now we see Team Alibaba, through Taobao, allowing WeChat Pay. On the other hand, Team Tencent, represented by Meituan, is integrating its services into Alipay, further demonstrating the shift towards a more interconnected digital landscape in China.

This changes have largely been driven by government enforcement. The shift towards deeper collaboration among China’s largest internet platforms comes in response to regulatory pressure, as the government continues to break down the barriers of closed ecosystems. A key example of this was the investigation into Alibaba’s unfair business practices, which was resolved just a few days ago, further pushing companies toward more open and fair competition.

As a result, new opportunities are emerging for platforms to expand their user bases and innovate beyond the limits of their previously isolated ecosystems. With these changes, the industry is likely to offer more interconnected and seamless digital experiences. The era of walled gardens is ending, replaced by a government-mandated paradigm of openness and cooperation. This marks a shift towards a more competitive, user-focused tech landscape in China, promising greater value and convenience for consumers moving forward.

Who Will Profit and who will lose out

Consumers will certainly benefit the most from these changes, gaining more convenience and choice as they can now seamlessly access services across multiple platforms without being locked into one ecosystem.

Dominant players like Meituan will likely profit significantly from the increased exposure, especially through integration with Alipay. Meituan has a clear scale advantage and offers superior services compared to competitors like Ele.me. Meanwhile, smaller, weaker players like Ele.me, previously shielded by their parent companies, could lose out as they face direct competition from stronger, more established rivals in this more open environment.

WeChat Pay, will likely gain ground over Alipay. WeChat is so ingrained in consumers’ daily lives that users prefer to stay within the app for everything, including payments. This centrality will give WeChat Pay an edge over Alipay, as there’s less incentive for users to switch payment platforms.

Taobao is also set to benefit from these changes, as the previous limitation of only accepting Alipay payments restricted its reach. Now, with WeChat Pay integration, Taobao can cater to a broader user base, which should boost transactions.

The open competition environment puts pressure on all companies to refine their operations, focusing on consumer needs and service excellence. Those who can deliver better, faster, and more convenient solutions will thrive, while those who have been protected by walled gardens but offer less competitive services will struggle to keep up. Ultimately, the companies that successfully adapt will emerge stronger, while those slow to respond or overly reliant on past advantages will find it increasingly difficult to maintain their market position.

Interesting to see Meituan offering services within Alipay's mini-programs and Taobao integrating WeChat as a payment method - giants are helping each other in the "winters".