In this article, I’m reviewing a couple of recent developments in Chinese companies. But let me set expectations right away—this isn’t a forensic dissection of every line item in the earnings report. I’m not here to list every number or walk you through the full income statement. Instead, I’m focusing on what actually stood out to me: shifts in strategy, subtle signals from management, things that may have been overlooked, or that could matter more than they appear at first glance.

This approach keeps things concise and focused. And as I’ll cover more companies later, I want to make sure we don’t get lost in the weeds. The goal here is clarity, not clutter.

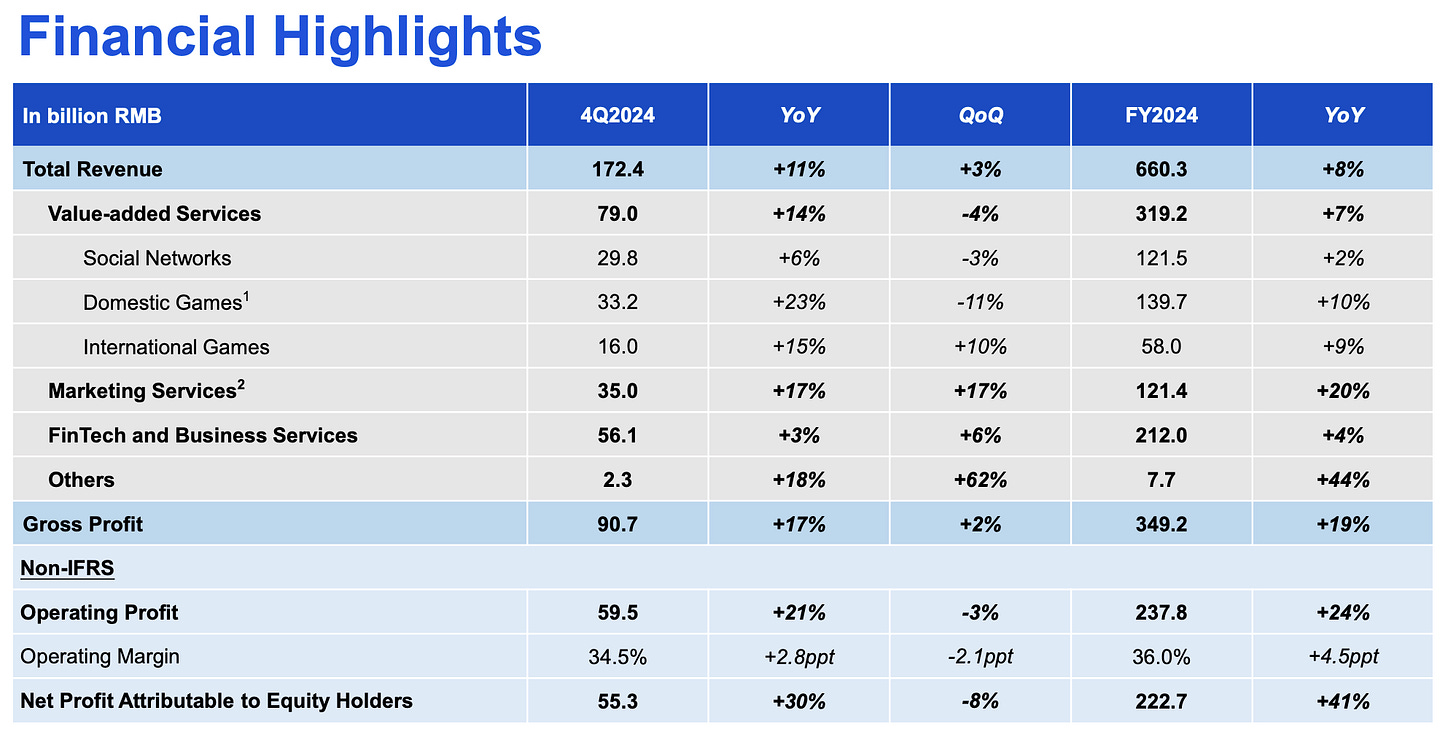

Tencent:

Before looking into the latest quarter, I want to mention a small exercise I did: I went through Tencent’s earnings calls and financials for the past two years—not just the headlines, but every single prediction they made. I cross-checked each one against actual outcomes—they’re astonishingly accurate. Whether it was a delay in game monetization, changes in monetization teams, or the timing of new features hitting the P&L, they got it right almost every time. There’s a pattern of consistency here. It shows how strong the management team really is.

That’s worth stating up front. Because this quarter, Tencent made some bold moves—and when they say they’re about to do something, they usually do.

Tencent’s AI Pivot: The Real Beginning

Tencent has worked on AI for almost a decade, but always with restraint. Even as late as Q3 2024, they said China’s SaaS environment was too weak and slow-growing compared to the U.S. (Decades of free Microsoft products and online movies have instilled an unwillingness among consumers to pay for software.)But something changed.

This quarter, AI wasn’t just a footnote. It was the main event.

Already in Q3, Tencent hinted at a more aggressive stance, saying they had “a lot of ammunition.” In hindsight, that was likely when the internal reset had already begun.

Then came DeepSeek.

DeepSeek didn’t just level the playing field—it acted as a reset button. Until recently, AI development was dominated by a kind of escalating arms race: each new model demanded more compute, more GPUs, more capital. The assumption was that only those who had already spent billions could stay competitive. For Tencent, which had long approached AI with caution, the economics of that race simply didn’t justify an all-out push.

But DeepSeek changed the equation. It demonstrated that meaningful progress could still be made without extreme spending or a long runway of prior investment. In doing so, it quietly diminished the structural lead that U.S. companies had built over the past few years. The AI race was no longer about who started first or who had the deepest pockets—it became about who could move next with more ingenuity and resourcefulness.

That reset appears to have prompted Tencent’s pivot. The company is now moving aggressively, with AI spending projected to reach the low-teens as a percentage of revenue in 2025.

The AI Rollout: Ads, Games, SaaS

Tencent now plans to embed AI into all of its products. It’s somewhat reminiscent of the moment in the early 2000s when Bill Gates declared that every Microsoft application must integrate the internet.

Key areas of application include:

Advertising: Improved targeting and higher click-through rates.

Gaming: More efficient development and monetization, with the potential to turn more titles into evergreen games.

SaaS: Enhancements to tools like Tencent Meeting and WeCom.

Because Tencent had taken a cautious approach to AI, they didn’t bet the farm on GPU capacity early on. When demand surged, they prioritized their own needs, allocating available GPUs to internal projects and deferring external client requests. By the end of 2024, however, they made a substantial GPU purchase. These will go online in Q2 2025, at which point Tencent will finally be able to support external cloud clients—opening up new revenue potential for their cloud business, even if margins remain relatively low.

CapEx vs. Margins: A Useful Clarification

Naturally, spending in the low-teens as a percentage of revenue on AI raises concerns about margin pressure. But Tencent explained that much of this CapEx is actually highly cash-generative. For example, their investments in ad tech are expected to deliver more precise targeting and improved click-through rates. In gaming, AI enables faster development cycles, better monetization, and the ability to turn titles into evergreen franchises. Even in the cloud business, clients pay for the services—so while margins may be low, the costs are at least covered.

The only area not yet monetizing effectively is consumer-facing AI, such as their LLM assistant, Yuanbao AI. Still, usage is growing rapidly—daily active users reportedly rose 20x between February and March.

The Evolution of Capital Allocation

I also found it interesting how Tencent framed their capital strategy shift as a three-act play.

Phase One: Ecosystem Investing. Heavy stakes in JD, Meituan, Pinduoduo, Kuaishou, and others.

Phase Two: Capital Return. Divesting from some of these companies (JD and Meituan), buying back Tencent shares.

Phase Three (Now): Reinvestment—into themselves. And that mostly means AI.

Notably, they also mentioned that a large portion of their capital remains liquid. That might sound like a footnote, but it could be a quiet signal to companies like Kuaishou and Pinduoduo: if the price is right, Tencent might divest further.

Mini Shops and commercial payments:

Last quarter’s big story was mini-shops—Tencent’s more direct push into e-commerce. For the first time, they sounded less like a short video platform and more like a serious commerce player. Mini-shops now sit at the center of the broader WeChat ecosystem, which functions almost like a Kraken—drawing in data from every corner: payments, social interactions, short and long videos, and user behavior across the platform. This deep integration gives Tencent a powerful foundation for personalized commerce.

On the commercial side, transaction volumes continue to rise, but pricing pressure remains. The average selling price is still under strain. Management believes consumer willingness to spend is gradually returning, which is encouraging. However, on the supply side, the environment is still highly competitive, with significant price-cutting. Tencent hopes this signals we’re nearing the tail end of a difficult market cycle. If consumer demand continues to strengthen, and the pricing pressure on suppliers eases, this could eventually translate into more sustainable value growth—but that remains to be seen.

The remaining part of this article is exclusive to subscribers. I take a closer look at Huya, who has just announced a dividend almost equal to 50% of its market cap. I also cover Meituan and discuss JD’s entry into food delivery, and how that could play out in an already crowded and competitive space. Consider subscribing to get the full analysis.

Keep reading with a 7-day free trial

Subscribe to The Great Wall Street - Investing in China to keep reading this post and get 7 days of free access to the full post archives.