Comments on Tencent’s Second Quarter Earnings.

How Tencent’s Strategic Shifts Are Paving the Way for Future Growth

Recent developments and strategy shift:

Tencent’s management has shown itself to be world-class, especially in navigating the challenges after the technology crackdown and adapting to shrinking revenues. They shifted from a high revenue growth strategy to focusing on operational leverage. By moving away from low-margin businesses and focusing on high-margin opportunities, Tencent has restructured its financial approach. The expansion of video accounts is a key example, using the established and paid-off WeChat platform to create new, profitable revenue streams on top. This has strengthened their advertising business and supported growth in their cloud and fintech segments.

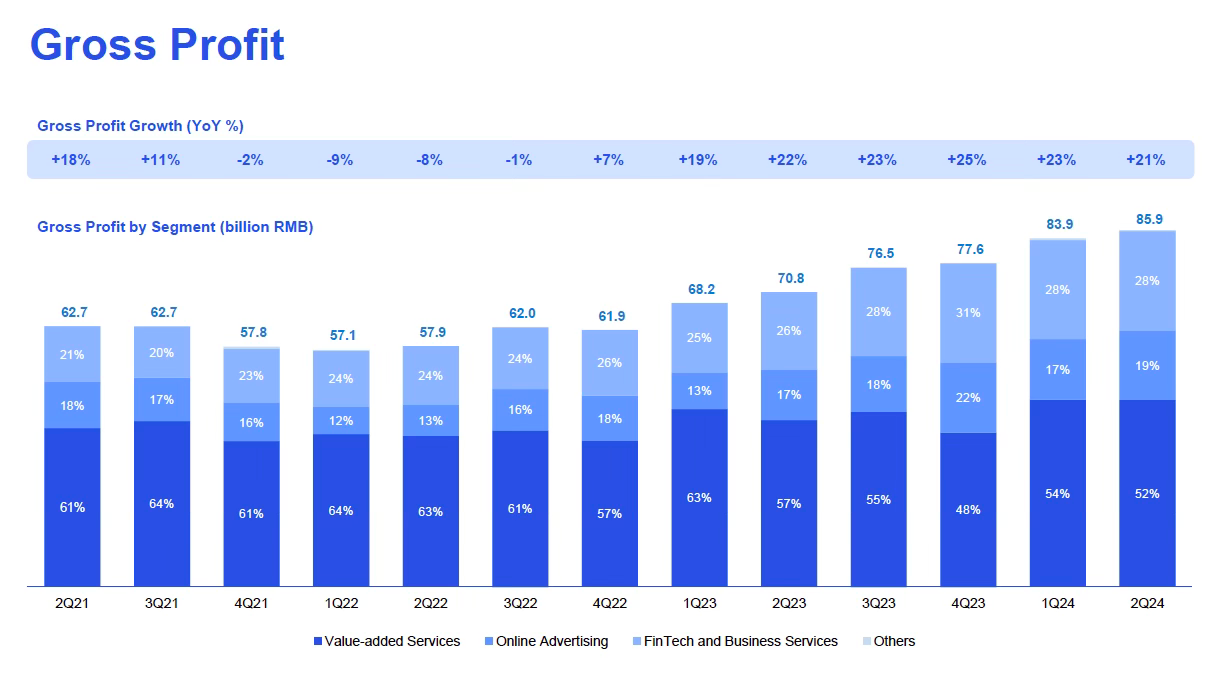

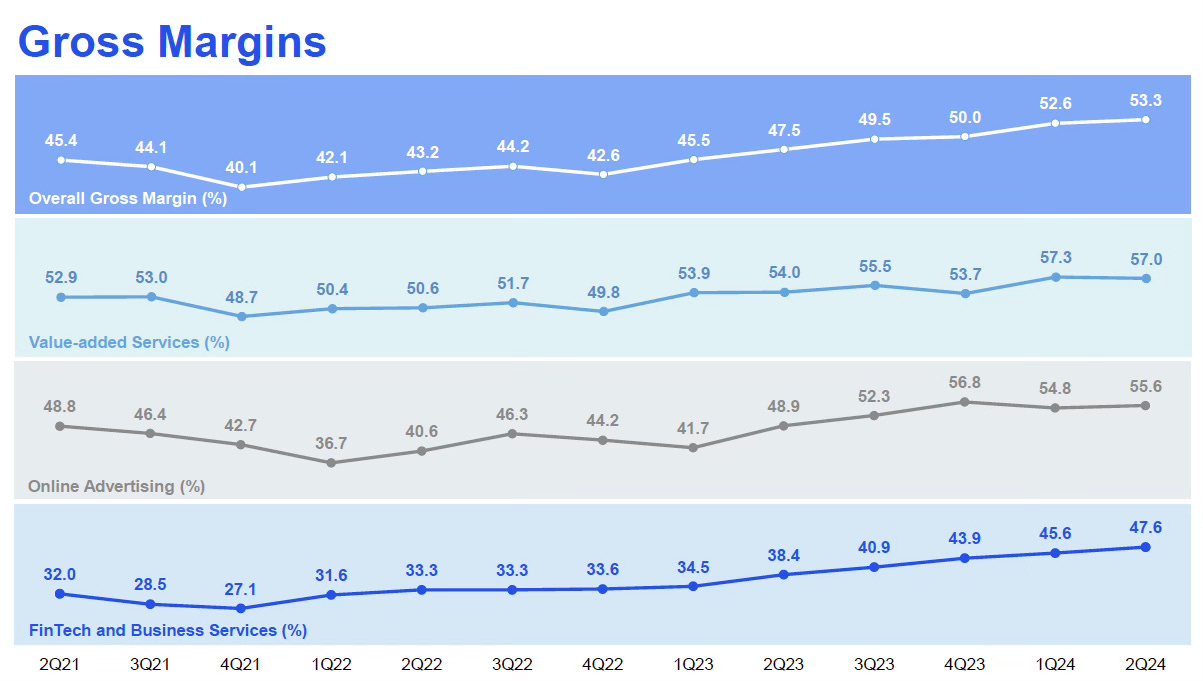

Recognizing issues within certain internal units, Tencent restructured its monetization teams for some video games, leading to greater efficiency. In addition to streamlining their workforce, they made the entire operation more efficient. This approach has been successful, with gross profit now growing at a multiple of 2.x times revenue growth. Tencent believes that their strategy of focusing on higher-margin businesses will be a multi-year trend. However, once the current efficiency initiatives are fully implemented and their impact is exhausted, they expect gross profit growth to slow down to around 1.x times the revenue growth rate.

Tencent’s management consistently sets clear strategic goals and delivers on them, with predictions from previous quarters continuing to materialize.

Effects of that strategy can be clearly seen:

Take, for example, Tencent’s FinTech and Business Services unit. They increased their gross profit margin from 27% in the fourth quarter of 2021 to 47.6% in the current quarter. This is a significant improvement and showcases the effectiveness of their strategy. Notably, Alibaba is now adopting a similar approach by phasing out low-margin projects in their cloud business. Tencent’s success is a key reason why I believe Alibaba BABA 0.00%↑ can return to double-digit growth in their cloud business, with much better margins moving forward.

General Overview

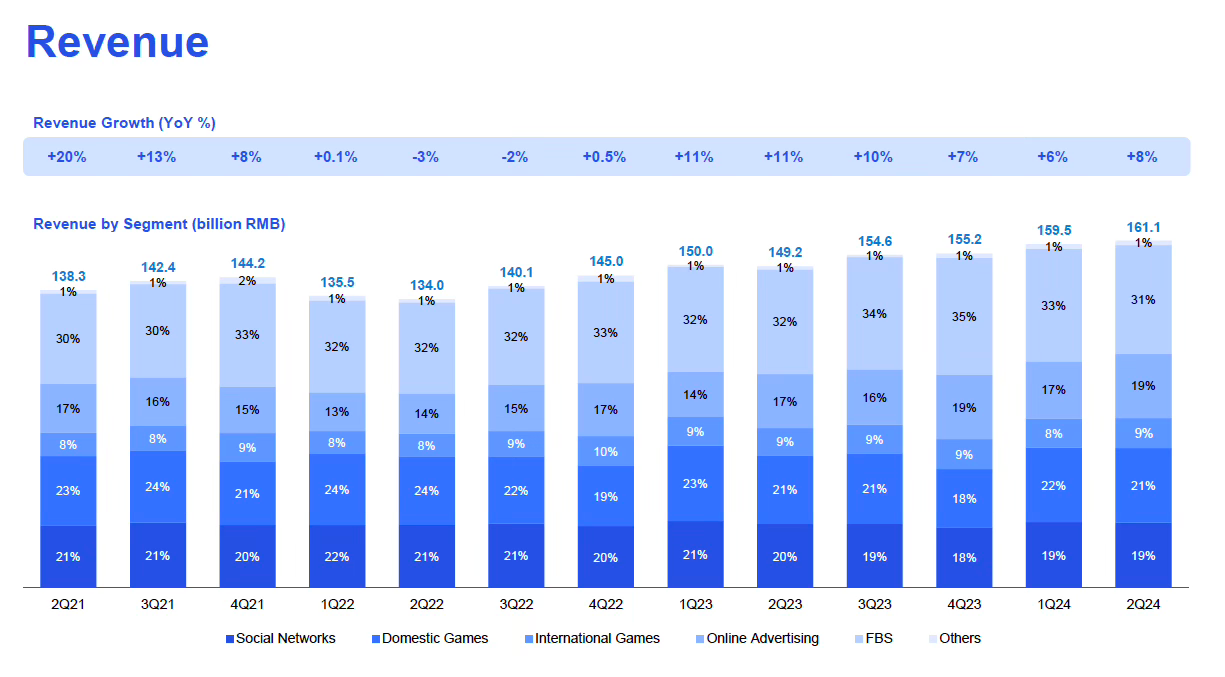

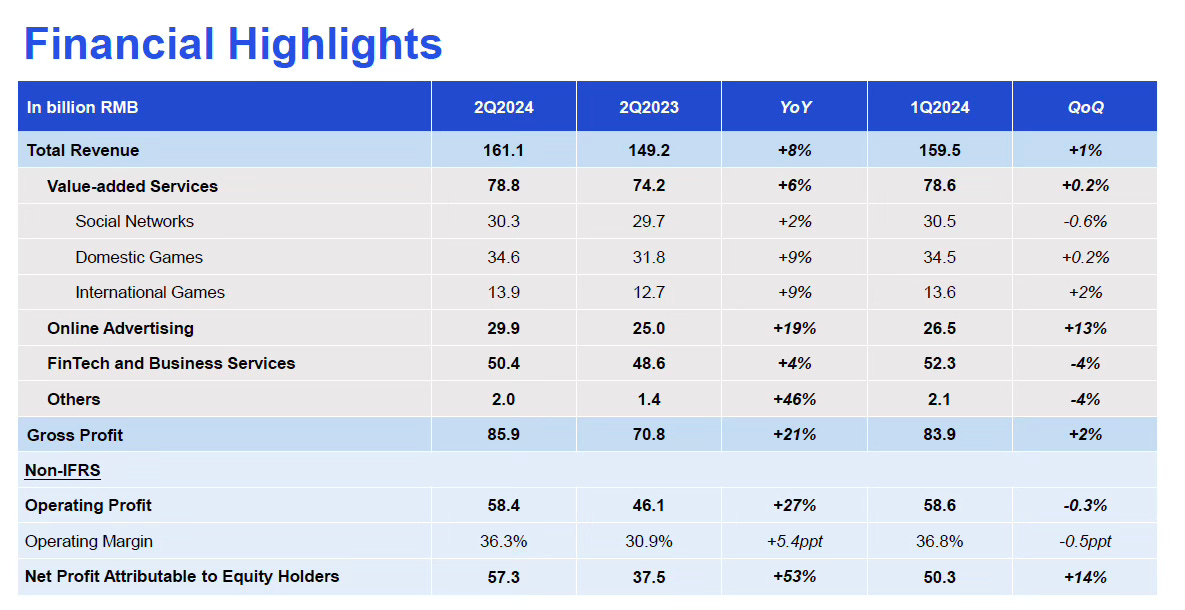

Tencent's revenue grew 8% this quarter. Operational leverage has driven gross profit up by 21% and operating profit by 27%, with free cash flow reaching 40.4 billion RMB, a 35% increase year-over-year. The fair value of their shareholdings stands at 564.5 billion RMB (79.2 billion USD), and the carrying book value of unlisted investments is 327.4 billion RMB (45.9 billion USD). Tencent mentioned that their investments are self-sustaining, and there was actually a net selling of equity rather than purchases this quarter. They repurchased shares worth 37.5 billion HKD and paid dividends totaling 31.7 billion HKD.

Domestic and International Games

Both domestic and international games experienced resumed and accelerated revenue growth, with gross receipts outpacing revenue growth, indicating potential for further revenue recognition in upcoming quarters. The reorganization of the monetization teams in previous quarters has improved monetization. The newly launched DnF Mobile was a huge success, becoming the highest-grossing game with first-month revenue exceeding 500 million USD.

Tencent acknowledges that the gaming environment remains challenging and that their business is inherently cyclical, characterized by periods of low innovation followed by rapid growth. While they appreciate the positive comments on the digital economy from the State Council, Tencent emphasizes that their investment strategy is long-term and not influenced by single pieces of information. This long-term focus has helped sustain their success, even amid recent challenges.

Value-Added Services

Tencent Video saw a 13% increase in subscriptions, reaching 117 million, driven by new content releases. Mini-programs saw a 20% increase in user time, contributing to GMV growth and a 30% increase in gross receipts from mini-games. Tencent also introduced Tencent Channels as a new feature. Tencent Music’s live-streaming business faced a decline similar to HUYA 0.00%↑ , but music subscriptions grew by 18% to 117 million. Given the regulatory crackdown on live streaming in China exactly one year ago, and Tencent’s proactive reduction of certain live streaming businesses for Huya and Tencent Music TME 0.00%↑ , I expect that revenue in these businesses will stabilize, if not increase, moving forward due to easier year-over-year comparisons.

This was the first time Tencent spoke positively about Tencent Video in a long time. It’s interesting to observe how similar businesses perform differently across geographies. Long-form video platforms like Tencent Video or iQIYI (IQ) are a mere shadow of their Western counterparts. I recently checked the market cap of Tencent’s main competitor in long-form videos, iQIYI, which has around 100 million user subscriptions. iQIYI’s market cap is currently about $3 billion. As a rough comparison, Netflix has roughly 100 times the market cap of iQIYI. Despite having more users than iQIYI, this difference is still quite remarkable.

Online Advertising

Online advertising revenue increased by 19% year-over-year, primarily driven by an 80% increase in video accounts ad revenue and a 30% increase in long-form video ad revenue. Growth was particularly strong in the gaming, e-commerce, and education sectors. However, mobile ad network revenue declined due to reduced advertising budgets from certain internet service companies, compounded by weaker consumer spending in China. Tencent believes they are gaining advertising market share, which should benefit them once consumer sentiment improves. Additionally, a shift toward closed-loop advertising within WeChat, supported by neural network artificial intelligence, is yielding higher CPM and click-through rates. Interestingly, they mentioned that they did not increase the ad inventory, so the growth was a combination of those both points.

In my opinion, it’s easy to overlook the significance of what’s happening here. While Tencent can’t control the macro environment, the current conditions obscure their gain in market share, which will become evident once consumer spending rebounds, leading to substantial improvements in Tencent’s earnings.

Another point that really stood out to me in this call was that Tencent commented on recent government policies without being directly asked about them. They stated that they view these policies very positively and believe they will encourage and eventually boost consumption. I was quite surprised by this, as they typically wouldn’t discuss such matters unprompted. This leads me to believe that this is truly their honest opinion, and they genuinely see these policies as beneficial, with improvements being a matter of when, not if.

Let me make another remark here: The regulatory crackdown on the education sector in China has essentially run its course. This pattern is typical in China: market misbehavior is often overlooked for a long time until the government steps in with harsh punishments. However, once the issues are addressed and the misbehavior is curbed, the situation gradually returns to normal. A few quarters ago, it would have been hard to imagine that the education sector would once again drive significant ad spending for major companies like Tencent. However, this is not surprising, as similar things have happened many times in the past.

Fintech

The fintech business grew 4% year-over-year, reflecting the impact of cautious consumer spending in China.

FinTech Services revenue growth decelerated to a low single-digit percentage rate, impacted by further moderation in commercial payment revenue growth that reflected slow consumption spending.

Despite this, wealth management fees saw double-digit growth, driven by a strong preference for savings. The number of commercial payment transactions increased at a healthy rate, although the average transaction value declined. Tencent is confident that their market share is increasing and that they will benefit when consumer spending improves.

Business Services

Business service revenue experienced teen growth, attributed to monetization from WeCom, e-commerce technology services within video accounts, and rising cloud revenue. Video accounts are increasingly contributing to cloud business growth, and AI-powered platform solutions are gaining traction in finance, education, and retail.

The revenue Tencent generates from providing GPUs for AI-related customers, although starting from a low base, is growing rapidly. This growth is driven by high AI demands, despite lower demand in China compared to the U.S. due to fewer well-funded startups. Nevertheless, AI-related external revenue is increasing steadily, supported by their investments in high-performance computing infrastructure.

Video Accounts

Tencent’s approach to video accounts is strategic and carefully planned. Instead of creating just another live streaming e-commerce platform, they are integrating video accounts into the existing WeChat ecosystem, which includes WeChat and mini programs. This is similar to their successful strategy with mini programs. While the revenue might not show up immediately, this integration will make video accounts much more valuable for merchants in the long run.

As mentioned by several people, the GMV growth of live streaming platforms like Douyin and Kuaishou has recently slowed from its initial huge success. Tencent responded to this during their earnings call by explaining that integrating video accounts into the WeChat ecosystem is expected to create a more sustainable and stable e-commerce business with higher growth potential than standalone platforms. This strategy could be a significant threat to Douyin and Kuaishou, as video accounts can leverage WeChat’s 1.35 billion users and connect with the merchants using mini programs, potentially making it a much stronger business in the future.

Operating Expenses and Capex

In contrast to recent quarters, expenses have risen. Selling and marketing expenses increased by 10% due to new content releases. Additionally, similar to major U.S. tech companies and Alibaba, CAPEX has grown rapidly to 7.2 billion RMB, a 144% year-over-year increase, primarily driven by AI investments and the purchase of GPU and CPU servers.

App Store Revenue Sharing and Conflicts

Tencent’s high-margin mini-games business recently came under scrutiny from Apple but also from Huawei. The issue arose because some mini-games were reportedly bypassing these platforms’ in-app purchase mechanisms, which would normally require revenue sharing. As a result, these games faced the potential of being restricted from updates in the respective app stores, similar to warnings Douyin received.

During an earnings call, Tencent’s management addressed the issue with the following points:

Many mini-games on iOS do not generate revenue through in-app transactions.

Tencent believes that revenue sharing should benefit all parties—Tencent, Apple, developers, and users—on a fair and sustainable basis.

Tencent is actively discussing the matter with Apple to find a resolution.

Until now, I never thought that Apple would actually push that button, but then I saw this situation unfold.

If this is really true, it would be economic suicide for Apple. A smartphone without WeChat and Douyin in China is as useful as a brick. I would immediately switch to Huawei, Xiaomi, or another brand. As much as the Chinese love their iPhones, they are a nice-to-have, but WeChat is essential. This would be the end for Apple in China.

Thanks. Nice write up.

Any discussion of Tencent Robotics?